Question: need help with this, thank you ! Problem 2 - Plant Asset Journal Entries - Prepare the journal entries requirad by the following transactions that

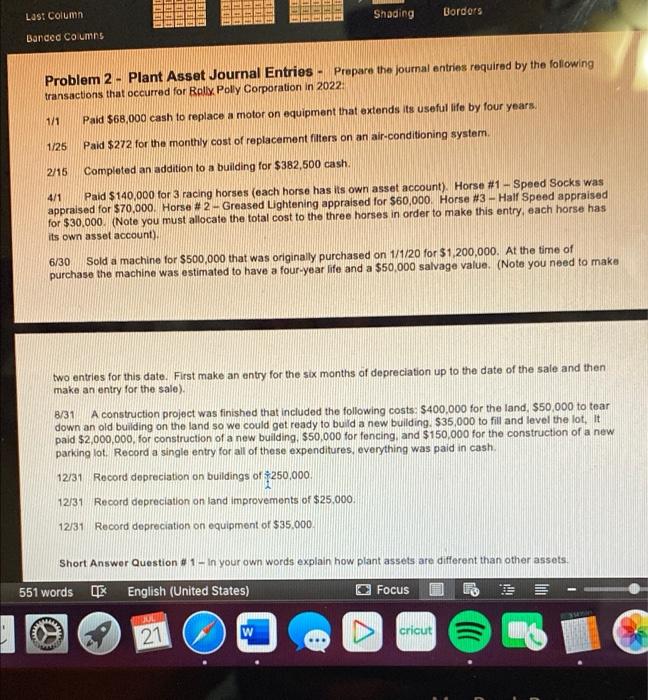

Problem 2 - Plant Asset Journal Entries - Prepare the journal entries requirad by the following transactions that occurred for Rolly. Poly Corporation in 2022: 111 Paid $68,000 cash to replace a motor on equipment that extends its useful life by four years. 1/26 Paid $272 for the monthly cost of replacement fitters on an air-conditioning system. 2/16 Completed an addition to a building for $382,500cash. 4/1 Paid $140,000 for 3 racing horses (each horse has its own asset account). Horse #1 - Speed Socks was appraised for $70,000. Horse # 2 - Greased Lightening appraised for $60,000. Horse #3 - Half Speed appraised for $30,000. (Note you must allocate the total cost to the three horses in order to make this entry, each horse has its own asset account). 6/30 Sold a machine for $500,000 that was originally purchased on 1/1/20 for $1,200,000. At the time of purchase the machine was estimated to have a four-year life and a $50,000 salvage value. (Note you need to make two entries for this date. First make an entry for the six months of depreciation up to the date of the sale and then make an entry for the sale). 8/31 A construction project was finished that included the following costs: $400,000 for the land, $50,000 to tear down an oid building on the land so we could get ready to build a new building. $35,000 to fill and level the lot, It paid $2,000,000, for construction of a new building. $50,000 for fencing, and $150,000 for the construction of a new parking lot. Record a single entry for all of these expenditures, everything was paid in cash. 12/31 Record depreciation on buildings of 250,000. 12131 Record depreciation on land improvements of $25.000. 12/31 Record depreciation on equipment of $35.000. Short Answer Question \&1 1- in your own words explain how plant assets are different than other assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts