Question: Need help with those 2 wrong parts. edugen.wileyplus.com/edugen/shared/assig Presented below are two independent transactions. Both transactions have commercial substance. 1. Mercy Co. exchanged old trucks

Need help with those 2 wrong parts.

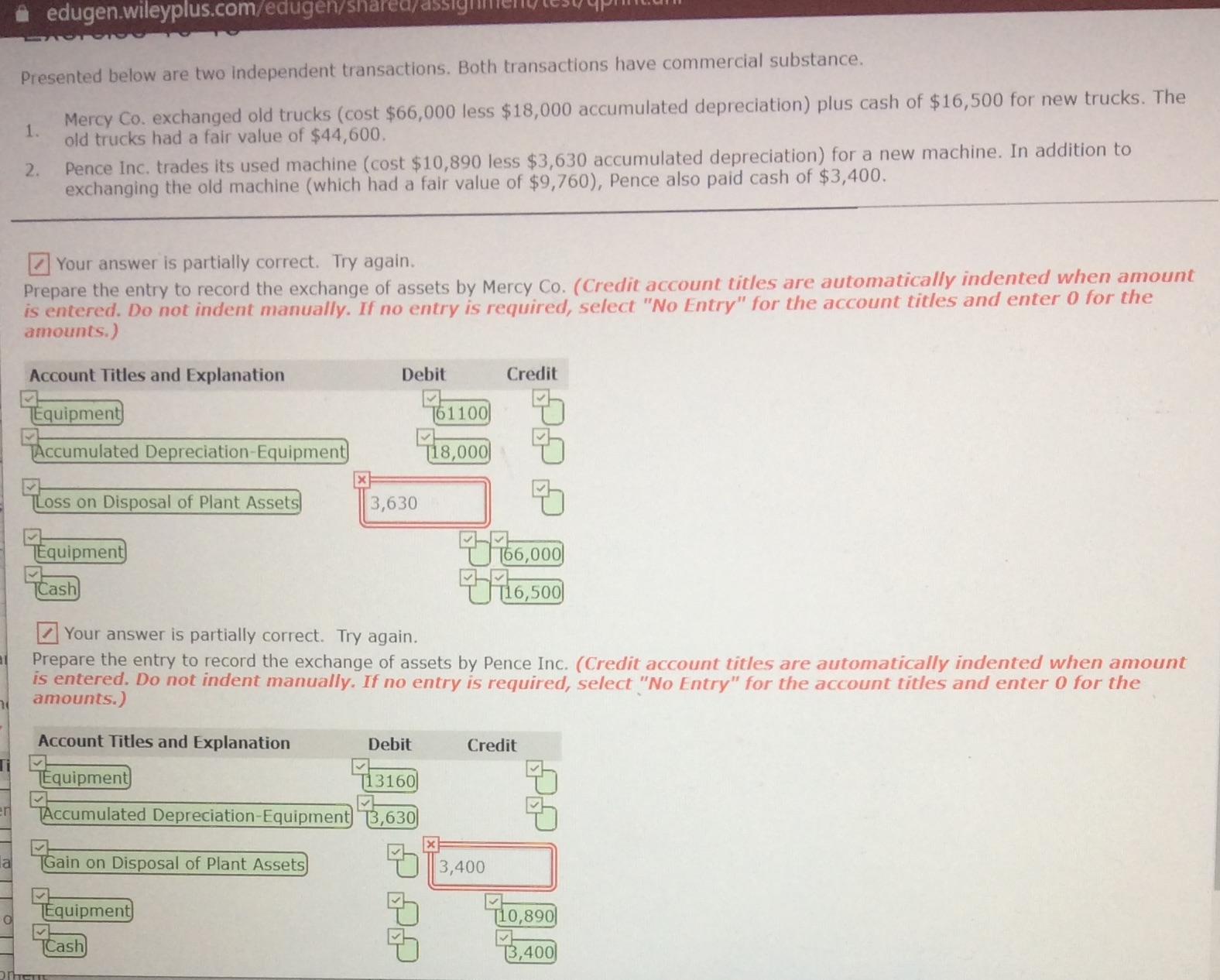

edugen.wileyplus.com/edugen/shared/assig Presented below are two independent transactions. Both transactions have commercial substance. 1. Mercy Co. exchanged old trucks (cost $66,000 less $18,000 accumulated depreciation) plus cash of $16,500 for new trucks. The old trucks had a fair value of $44,600. 2. Pence Inc. trades its used machine (cost $10,890 less $3,630 accumulated depreciation) for a new machine. In addition to exchanging the old machine (which had a fair value of $9,760), Pence also paid cash of $3,400. Your answer is partially correct. Try again. Prepare the entry to record the exchange of assets by Mercy Co. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Equipment 61 100 Accumulated Depreciation-Equipment 18,000 x Loss on Disposal of Plant Assets 3,630 M. Equipment 66,000 Cash 16,500 Your answer is partially correct. Try again. Prepare the entry to record the exchange of assets by Pence Inc. (Credit account titles are automatically indented when amount amounts.) is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the Account Titles and Explanation Debit Credit Equipment T13160 [Accumulated Depreciation-Equipment (3,630 X Gain on Disposal of Plant Assets 3,400 Equipment 10,890 Cash 13,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts