Question: Need help with what I got wrong, please. Need help with what I got wrong, please. eBook B Print Que 6 Partially correct Mark 4.00

Need help with what I got wrong, please. Need help with what I got wrong, please.

Need help with what I got wrong, please.

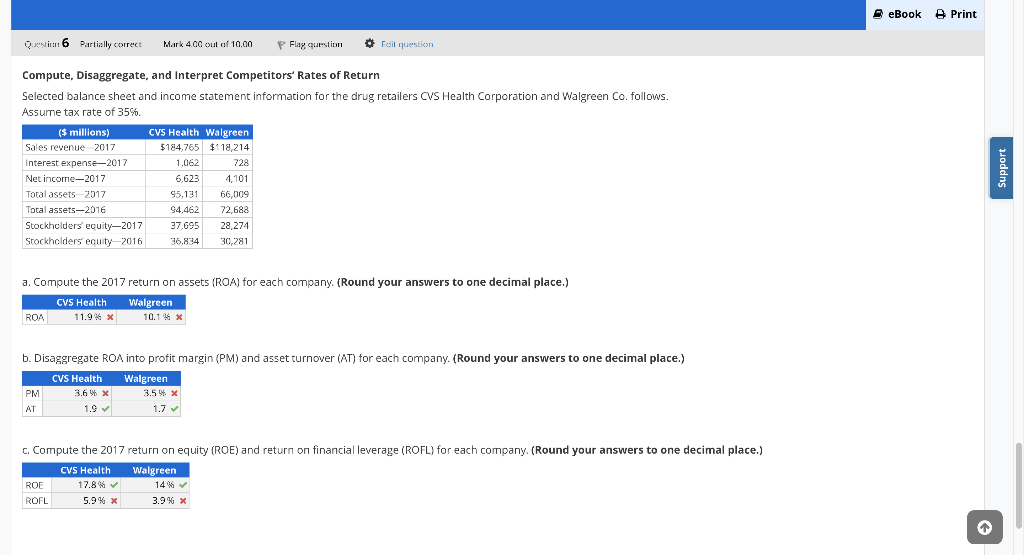

eBook B Print Que 6 Partially correct Mark 4.00 out of 10,00 P Flag question Edit question Compute, Disaggregate, and Interpret Competitors' Rates of Return Selected balance sheet and income statement information for the drug retailers CVS Health Corporation and Walgreen Co. follows. Assume tax rate of 35%. ($ millions) CVS Health Walgreen Sales revenue 2017 $184,765 $118,214 Interest expense-2017 1,062 728 Net income-2017 6.623 4,101 CE Total assets-2017 95,131 66,009 Total assets-2016 94,462 72,688 Stockholders' equity-2017 37,695 28,274 Stockholders equity-2016 36,834 30,281 I a. Compute the 2017 return on assets (ROA) for each company. (Round your answers to one decimal place.) CVS Health Walgreen ROA 11.9% X 10.1" X b. Disaggregate ROA into profit margin (PM) and asset turnover (AT) for each company. (Round your answers to one decimal place.) CVS Health Walgreen PM 3.690 X 3.5" x AT 1.9 1.7 C. Compute the 2017 return on equity (ROE) and return on financial leverage (ROFL) for each company. (Round your answers to one decimal place.) CVS Health Walgreen 17.8% 14% ROFL 5.9% X 3.9% X ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts