Question: need help with working out please Asset A has an expected rate of return of 9% with a standard deviation of 10%. Asset B has

need help with working out please

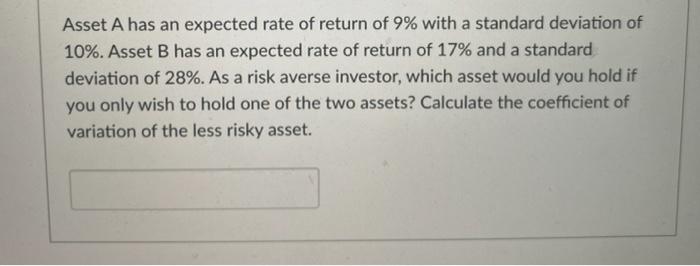

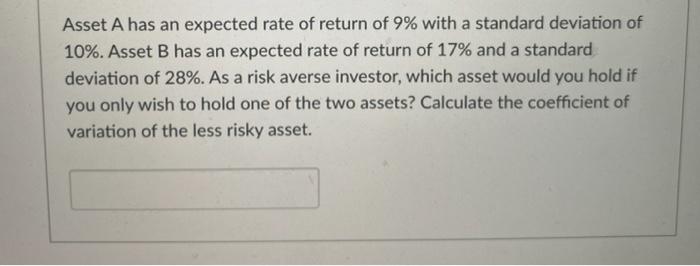

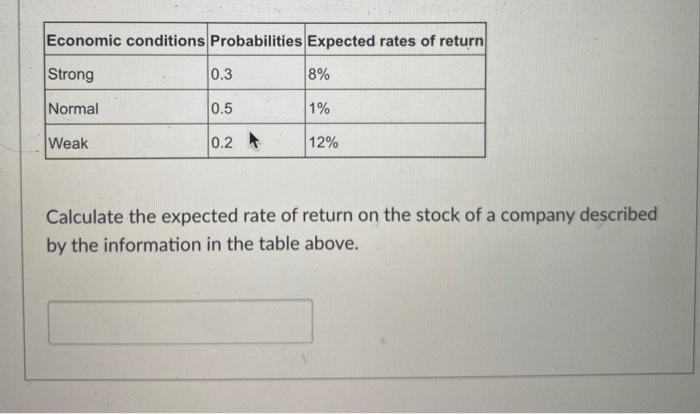

Asset A has an expected rate of return of 9% with a standard deviation of 10%. Asset B has an expected rate of return of 17% and a standard deviation of 28%. As a risk averse investor, which asset would you hold if you only wish to hold one of the two assets? Calculate the coefficient of variation of the less risky asset. Economic conditions Probabilities Expected rates of return Strong 0.3 8% Normal 0.5 1% Weak 10.2 A 12% Calculate the expected rate of return on the stock of a company described by the information in the table above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock