Question: NEED IN 30 MIN ASAP PLEASE!!! PLEASE SHOW WORK!! Question 19 8 points Save Answer South Mining Co. (SMC) paid $200 million for the right

NEED IN 30 MIN ASAP PLEASE!!! PLEASE SHOW WORK!!

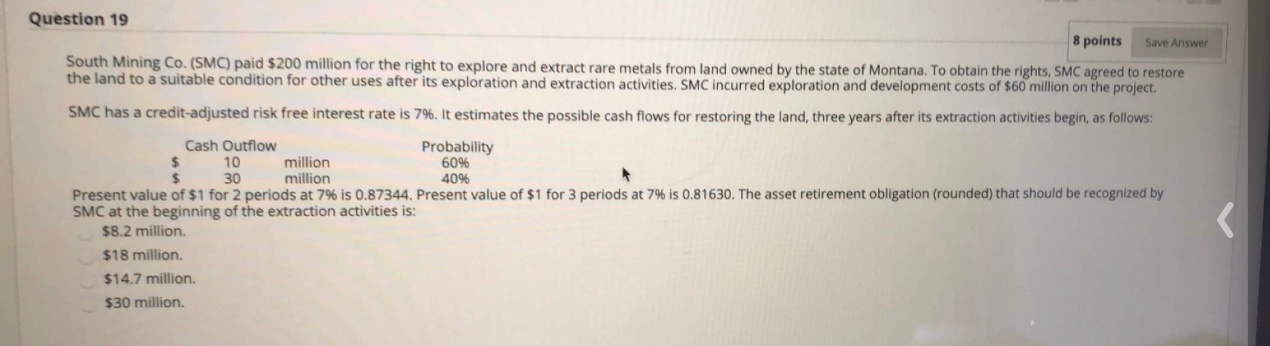

Question 19 8 points Save Answer South Mining Co. (SMC) paid $200 million for the right to explore and extract rare metals from land owned by the state of Montana. To obtain the rights, SMC agreed to restore the land to a suitable condition for other uses after its exploration and extraction activities. SMC incurred exploration and development costs of $60 million on the project SMC has a credit-adjusted risk free interest rate is 7%. It estimates the possible cash flows for restoring the land, three years after its extraction activities begin, as follows: Cash Outflow Probability 10 million 6096 30 million 4096 Present value of $1 for 2 periods at 7% is 0.87344. Present value of $1 for 3 periods at 7% is 0.81630. The asset retirement obligation (rounded) that should be recognized by SMC at the beginning of the extraction activities is: $8.2 million $18 million. $14.7 million. $30 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts