Question: Need include Prepare a worksheet that includes company name, date, trial balance, adjustments, adjusted trial balance, income statement, statement of owners equity and balance sheet.

Need include Prepare a worksheet that includes company name, date, trial balance, adjustments, adjusted trial balance, income statement, statement of owners equity and balance sheet.

Need include Prepare a worksheet that includes company name, date, trial balance, adjustments, adjusted trial balance, income statement, statement of owners equity and balance sheet.

EXCEL FORMAT please!!!!

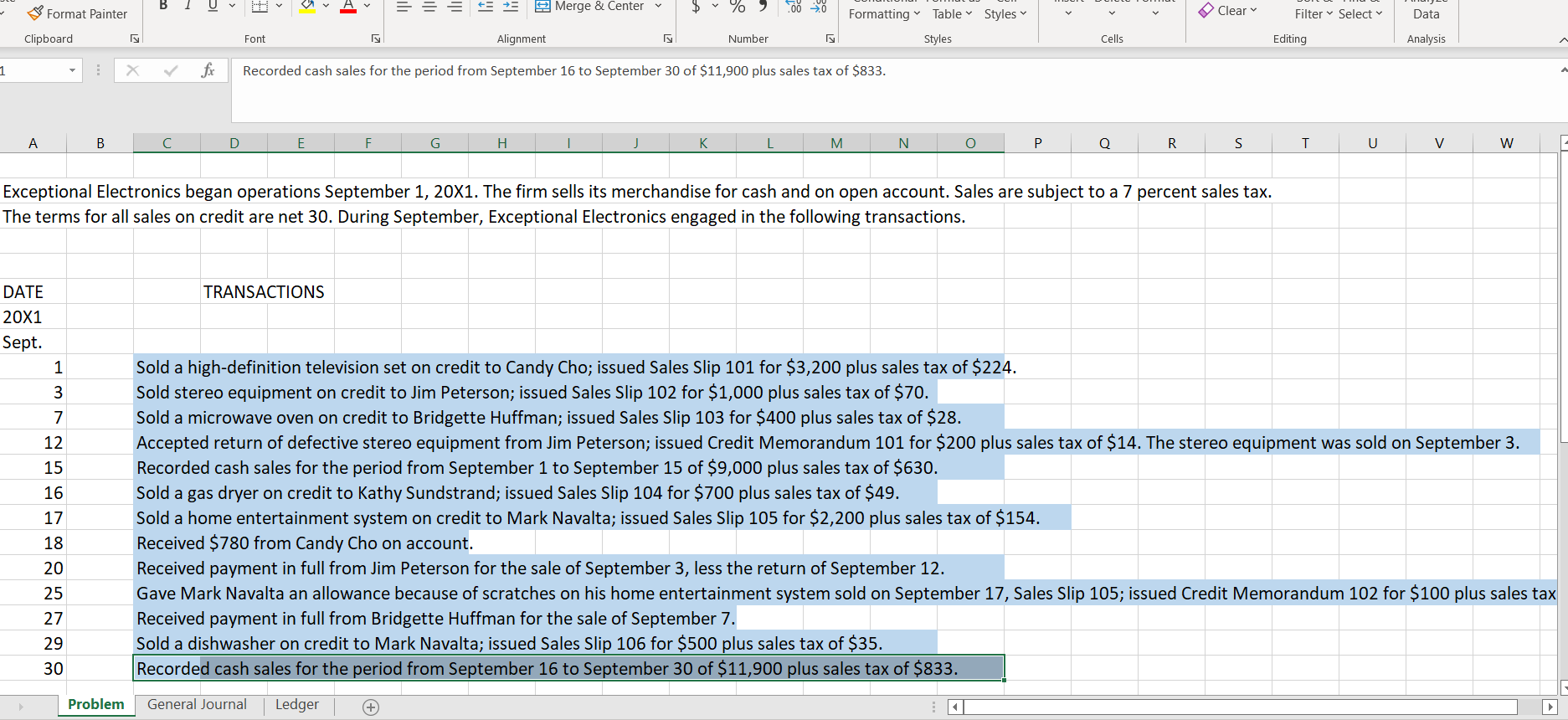

B TU 5 Format Painter + Merge & Center 00 20 Formatting Table Styles Clear Filter Select Data Clipboard Font Alignment Number Styles Cells Editing Analysis 1 X fx Recorded cash sales for the period from September 16 to September 30 of $11,900 plus sales tax of $833. A B D E F G H K M N O 0 R S T > W Exceptional Electronics began operations September 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 7 percent sales tax. The terms for all sales on credit are net 30. During September, Exceptional Electronics engaged in the following transactions. TRANSACTIONS DATE 20X1 Sept. 1 3 7 12 15 16 17 18 20 25 27 29 30 Sold a high-definition television set on credit to Candy Cho; issued Sales Slip 101 for $3,200 plus sales tax of $224. Sold stereo equipment on credit to Jim Peterson; issued Sales Slip 102 for $1,000 plus sales tax of $70. Sold a microwave oven on credit to Bridgette Huffman; issued Sales Slip 103 for $400 plus sales tax of $28. Accepted return of defective stereo equipment from Jim Peterson; issued Credit Memorandum 101 for $200 plus sales tax of $14. The stereo equipment was sold on September 3. Recorded cash sales for the period from September 1 to September 15 of $9,000 plus sales tax of $630. Sold a gas dryer on credit to Kathy Sundstrand; issued Sales Slip 104 for $700 plus sales tax of $49. Sold a home entertainment system on credit to Mark Navalta; issued Sales Slip 105 for $2,200 plus sales tax of $154. Received $780 from Candy Cho on account. Received payment in full from Jim Peterson for the sale of September 3, less the return of September 12. Gave Mark Navalta an allowance because of scratches on his home entertainment system sold on September 17, Sales Slip 105; issued Credit Memorandum 102 for $100 plus sales tax Received payment in full from Bridgette Huffman for the sale of September 7. Sold a dishwasher on credit to Mark Navalta; issued Sales Slip 106 for $500 plus sales tax of $35. Recorded cash sales for the period from September 16 to September 30 of $11,900 plus sales tax of $833. Problem General Journal Ledger B TU 5 Format Painter + Merge & Center 00 20 Formatting Table Styles Clear Filter Select Data Clipboard Font Alignment Number Styles Cells Editing Analysis 1 X fx Recorded cash sales for the period from September 16 to September 30 of $11,900 plus sales tax of $833. A B D E F G H K M N O 0 R S T > W Exceptional Electronics began operations September 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 7 percent sales tax. The terms for all sales on credit are net 30. During September, Exceptional Electronics engaged in the following transactions. TRANSACTIONS DATE 20X1 Sept. 1 3 7 12 15 16 17 18 20 25 27 29 30 Sold a high-definition television set on credit to Candy Cho; issued Sales Slip 101 for $3,200 plus sales tax of $224. Sold stereo equipment on credit to Jim Peterson; issued Sales Slip 102 for $1,000 plus sales tax of $70. Sold a microwave oven on credit to Bridgette Huffman; issued Sales Slip 103 for $400 plus sales tax of $28. Accepted return of defective stereo equipment from Jim Peterson; issued Credit Memorandum 101 for $200 plus sales tax of $14. The stereo equipment was sold on September 3. Recorded cash sales for the period from September 1 to September 15 of $9,000 plus sales tax of $630. Sold a gas dryer on credit to Kathy Sundstrand; issued Sales Slip 104 for $700 plus sales tax of $49. Sold a home entertainment system on credit to Mark Navalta; issued Sales Slip 105 for $2,200 plus sales tax of $154. Received $780 from Candy Cho on account. Received payment in full from Jim Peterson for the sale of September 3, less the return of September 12. Gave Mark Navalta an allowance because of scratches on his home entertainment system sold on September 17, Sales Slip 105; issued Credit Memorandum 102 for $100 plus sales tax Received payment in full from Bridgette Huffman for the sale of September 7. Sold a dishwasher on credit to Mark Navalta; issued Sales Slip 106 for $500 plus sales tax of $35. Recorded cash sales for the period from September 16 to September 30 of $11,900 plus sales tax of $833. Problem General Journal Ledger

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts