Question: Need it in this format On January 1, 2018, Friendly Farm Company purchased a new machine at a cost of $350,000. The machine has an

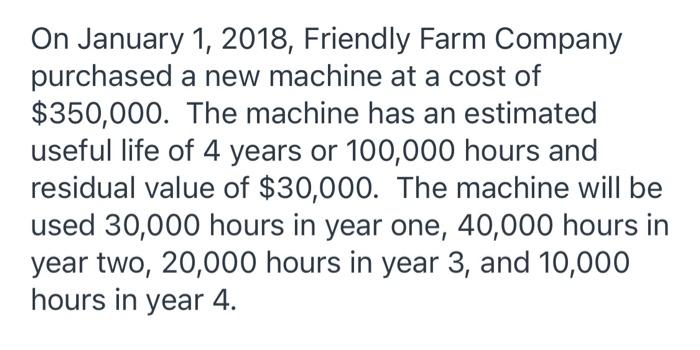

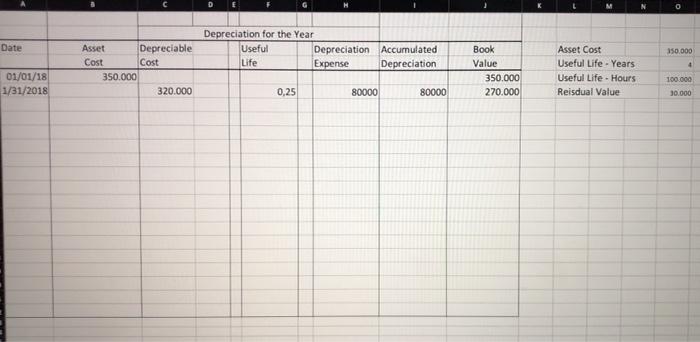

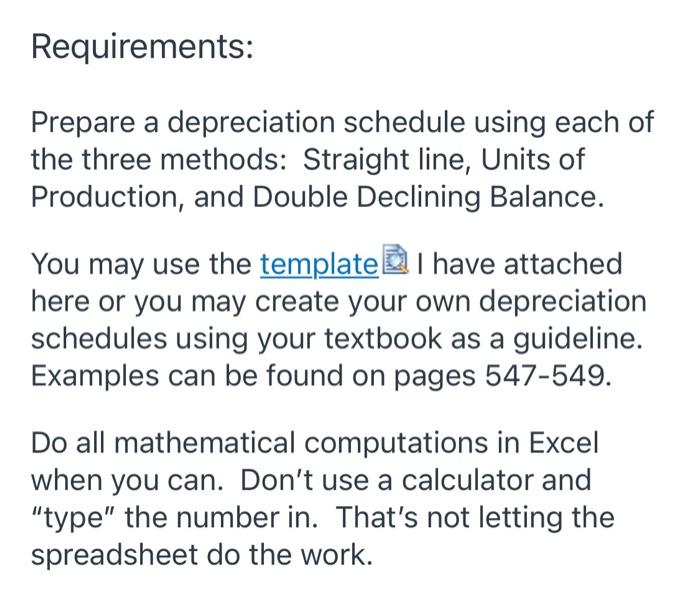

On January 1, 2018, Friendly Farm Company purchased a new machine at a cost of $350,000. The machine has an estimated useful life of 4 years or 100,000 hours and residual value of $30,000. The machine will be used 30,000 hours in year one, 40,000 hours in year two, 20,000 hours in year 3, and 10,000 hours in year 4. C D N Date Depreciation for the Year Useful Depreciation Accumulated Life Expense Depreciation Asset Depreciable Cost Cost 350.000 320.000 350.000 Book Value 350.000 270.000 Asset Cost Useful Life - Years Useful Life - Hours Reisdual Value 100.000 01/01/18 1/31/2018 0,25 80000 80000 30.000 Requirements: Prepare a depreciation schedule using each of the three methods: Straight line, Units of Production, and Double Declining Balance. You may use the template I have attached here or you may create your own depreciation schedules using your textbook as a guideline. Examples can be found on pages 547-549. Do all mathematical computations in Excel when you can. Don't use a calculator and "type" the number in. That's not letting the spreadsheet do the work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts