Question: solve this problem using the 3 methods and You may use the template I have attached here or you may create your own depreciation schedules

solve this problem using the 3 methods and You may use the template I have attached here or you may create your own depreciation schedules using your textbook as a guideline.

I have attached here or you may create your own depreciation schedules using your textbook as a guideline.

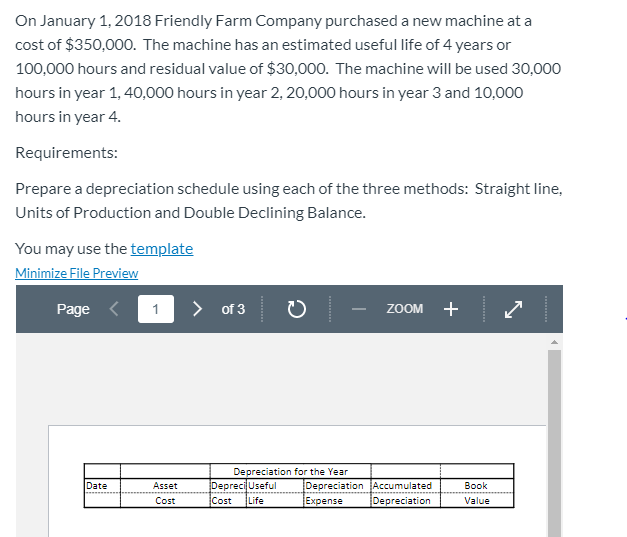

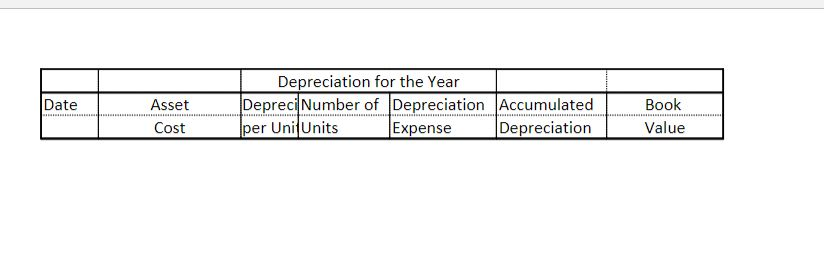

On January 1, 2018 Friendly Farm Company purchased a new machine at a cost of $350,000. The machine has an estimated useful life of 4 years or 100,000 hours and residual value of $30,000. The machine will be used 30,000 hours in year 1,40,000 hours in year 2, 20,000 hours in year 3 and 10,000 hours in year 4. Requirements: Prepare a depreciation schedule using each of the three methods: Straight line, Units of Production and Double Declining Balance. You may use the template Minimize File Preview Page of 3 0 - ZOOM + Asset Cost Depreciation for the Year Depreci Useful Depreciation Accumulated Cost Life Expense Depreciation Book Value Date Depreciation for the Year Depreci Number of Depreciation Accumulated per Uni Units Expense Depreciation Asset Cost D Book Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts