Question: need it step by step asap 1. (4 points) Assume that all assets are being used at 90% capacity . Sales are currently $1200, expected

need it step by step asap

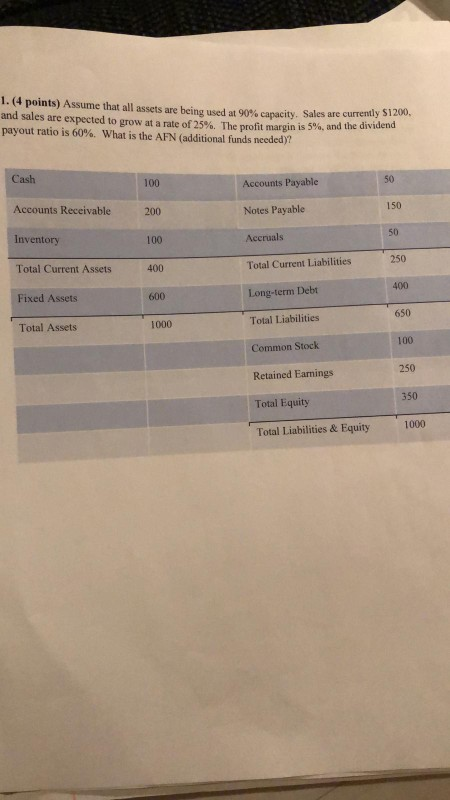

1. (4 points) Assume that all assets are being used at 90% capacity . Sales are currently $1200, expected to grow at a rate of 25% . The profit margin is 5% , and the dividend and sales are payout ratio is 60%. What is the AFN (additional funds needed)? Cash 50 100 Accounts Payable 150 Accounts Receivable Notes Payable 200 50 Accruals Inventory 100 250 Total Current Liabilities Total Current Assets 400 400 Long-term Debt 600 Fixed Assets 650 Total Liabilities 1000 Total Assets 100 Common Stock 250 Retained Earnings 350 Total Equity 1000 Total Liabilities & Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts