Question: Need only Math and formula part with explanations. solve maths part using formulas. Based on a single factor, model, you have performed the following regressions

Need only Math and formula part with explanations. solve maths part using formulas.

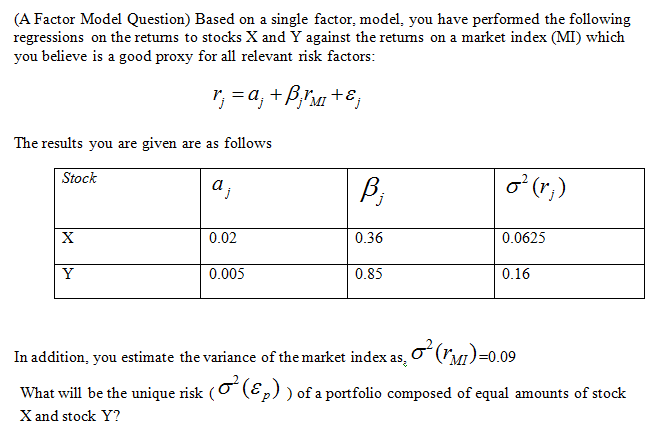

Based on a single factor, model, you have performed the following regressions on the returns to stocks X and Y against the returns on a market index (MI) which you believe is a good proxy for all relevant risk factors: r_j = a_j + beta_j r_MI + epsilon_j The results you are given are as follows In addition, you estimate the variance of the market index as. Sigma^2 (r_MI) = 0.09 What will be the unique risk (sigma^2 (epsilon_p)) of a portfolio composed of equal amounts of stock X and stock Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts