Question: Need only Math and formula part with explanations. solve maths part using formulas. You wish to invest into two mutual funds A and B. The

Need only Math and formula part with explanations. solve maths part using formulas.

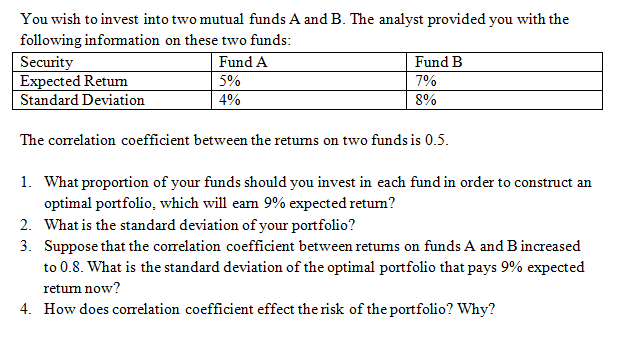

You wish to invest into two mutual funds A and B. The analyst provided you with the following information on these two funds: The correlation coefficient between the returns on two funds is 0.5. What proportion of your funds should you invest in each fund in order to construct an optimal portfolio, which will earn 9% expected return? What is the standard deviation of your portfolio? Suppose that the correlation coefficient between returns on funds A and B increased to 0.8. What is the standard deviation of the optimal portfolio that pays 9% expected return now? How does correlation coefficient effect the risk of the portfolio? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts