Question: need ONLY question 2 please D Question 1 1 pts Questions 1-8 are based on the followving information: UA purchased an aircraft from Airbus and

need ONLY question 2 please

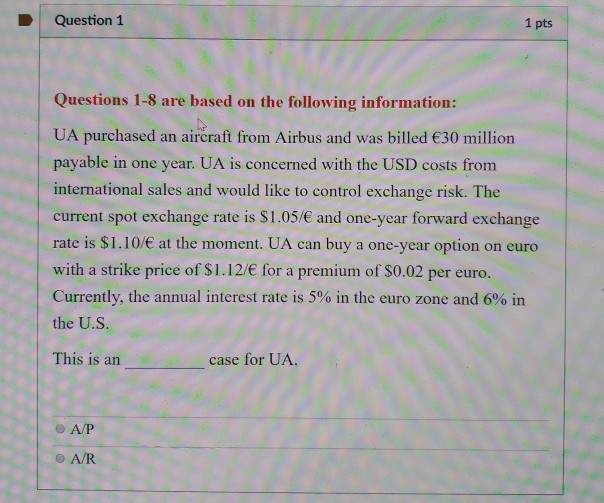

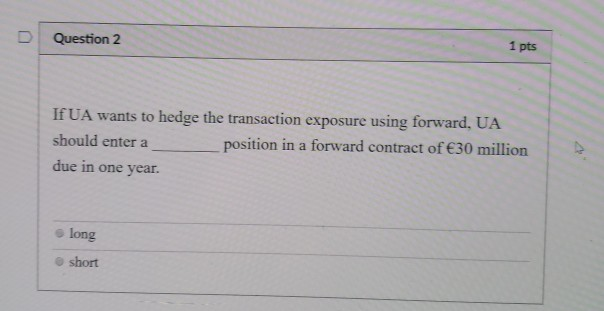

D Question 1 1 pts Questions 1-8 are based on the followving information: UA purchased an aircraft from Airbus and was billed 30 million payable in one year. UA is concerned with the USD costs from international sales and would like to control exchange risk. The current spot exchange rate is $1.05/E and one-year forward exchange rate is $1.10/ at the moment. UA can buy a one-year option on euro with a strike price of $1.12/ for a premium of $0.02 per euro. Currently, the annual interest rate is 5% in the euro zone and 600 in the U.S. This is ancase for UA e A/P A/R DQuestion 2 1 pts If UA wants to hedge the transaction exposure using forward, UA ld enter aposition in a forward contract of 30 million due in one year. s long O short

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts