Question: need q.40 , required immediately (within 15 min. pls) Question 39 Use your solution to the following problem to answer questions 39 and 40. Assume

need q.40 , required immediately (within 15 min. pls)

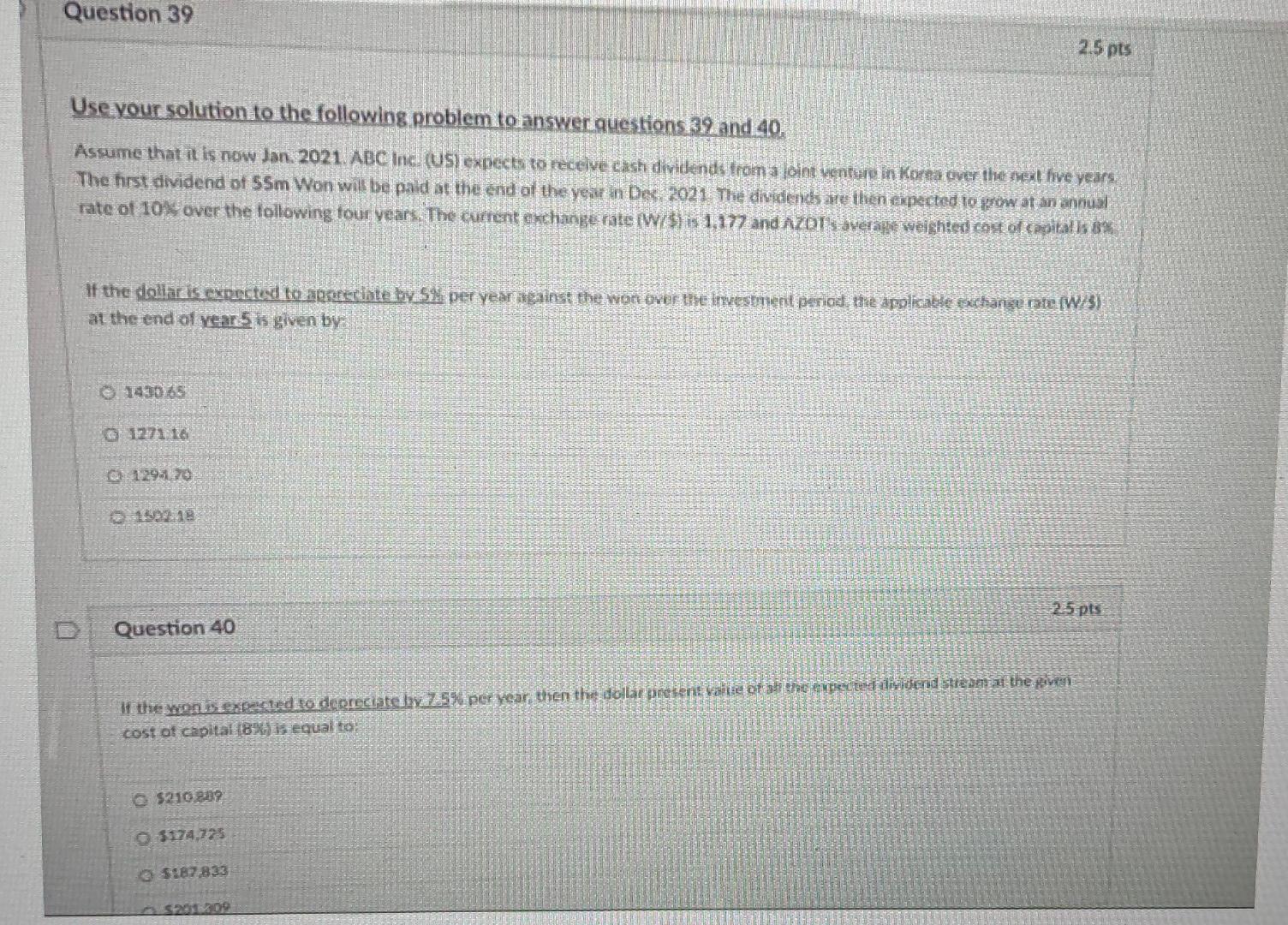

Question 39 Use your solution to the following problem to answer questions 39 and 40. Assume that it is now Jan. 2021. ABC Inc. (US) expects to receive cash dividends from a joint venture in Korea over the next five years. The first dividend of 55m Won will be paid at the end of the year in Dec. 2021 The dividends are then expected to grow at an annual rate of 10% over the following four years. The current exchange rate (W/$) is 1,177 and AZOT's average weighted cost of capital is 8% If the dollar is expected to appreciate by 5% per year against the won over the investment period, the applicable exchange rate (W/5) at the end of year 5 is given by: 143065 1271 16 1294.70 1502.18 Question 40 If the won is expected to depreciate by 7.5% per year, then the dollar present value of all the expected dividend stream at the given cost of capital (8%) is equal to $210.889 O $174,725 2.5 pts $187.833 $201309 2.5 pts Question 39 Use your solution to the following problem to answer questions 39 and 40. Assume that it is now Jan. 2021. ABC Inc. (US) expects to receive cash dividends from a joint venture in Korea over the next five years. The first dividend of 55m Won will be paid at the end of the year in Dec. 2021 The dividends are then expected to grow at an annual rate of 10% over the following four years. The current exchange rate (W/$) is 1,177 and AZOT's average weighted cost of capital is 8% If the dollar is expected to appreciate by 5% per year against the won over the investment period, the applicable exchange rate (W/5) at the end of year 5 is given by: 143065 1271 16 1294.70 1502.18 Question 40 If the won is expected to depreciate by 7.5% per year, then the dollar present value of all the expected dividend stream at the given cost of capital (8%) is equal to $210.889 O $174,725 2.5 pts $187.833 $201309 2.5 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts