Question: need question 4 and 5 BIUX, A A Paragraph Styles Dietato Sen 9. A 25-year-old dient Just Inherited an investment account. The asset-allocation is 70%

need question 4 and 5

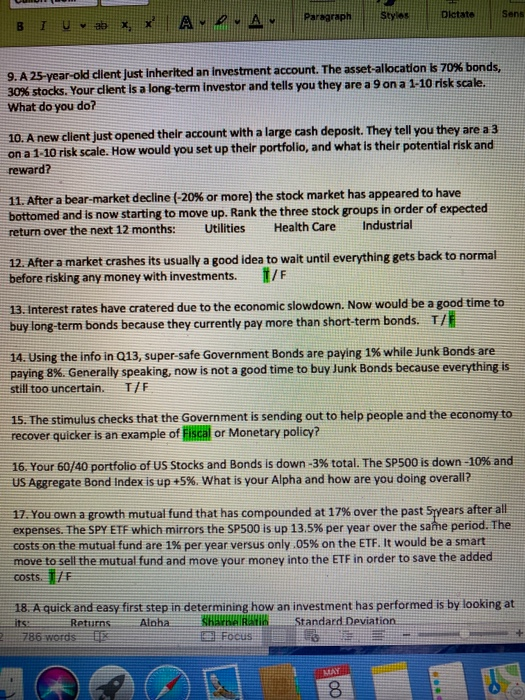

need question 4 and 5BIUX, A A Paragraph Styles Dietato Sen 9. A 25-year-old dient Just Inherited an investment account. The asset-allocation is 70% bonds, 30% stocks. Your client is a long-term investor and tells you they are a 9 on a 1-10 risk scale. What do you do? 10. A new client just opened their account with a large cash deposit. They tell you they are a 3 on a 1-10 risk scale. How would you set up their portfolio, and what is their potential risk and reward? 11. After a bear-market decline (-20% or more) the stock market has appeared to have bottomed and is now starting to move up. Rank the three stock groups in order of expected return over the next 12 months: Utilities Health Care Industrial 12. After a market crashes its usually a good idea to wait until everything gets back to normal before risking any money with investments. /F 13. Interest rates have cratered due to the economic slowdown. Now would be a good time to buy long-term bonds because they currently pay more than short-term bonds. T/E 14. Using the info in Q13, super-safe Government Bonds are paying 1% while Junk Bonds are paying 8%. Generally speaking, now is not a good time to buy Junk Bonds because everything is still too uncertain. T/F 15. The stimulus checks that the Government is sending out to help people and the economy to recover quicker is an example of Fiscal or Monetary policy? 16. Your 60/40 portfolio of US Stocks and Bonds is down -3% total. The SP500 is down -10% and US Aggregate Bond Index is up +5%. What is your Alpha and how are you doing overall? 17. You own a growth mutual fund that has compounded at 17% over the past Syyears after all expenses. The SPY ETF which mirrors the SP500 is up 13.5% per year over the same period. The costs on the mutual fund are 1% per year versus only.05% on the ETF. It would be a smart move to sell the mutual fund and move your money into the ETF in order to save the added costs. 1/F 18. A quick and easy first step in determining how an investment has performed is by looking at Aloha Shah Standard Deviation 786 words El Focus 133

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts