Question: need quick response and correct answer for a thumb up QUESTION [25 marl] Trace and Bruce are an elderly couple in their late forties and

need quick response and correct answer for a thumb up

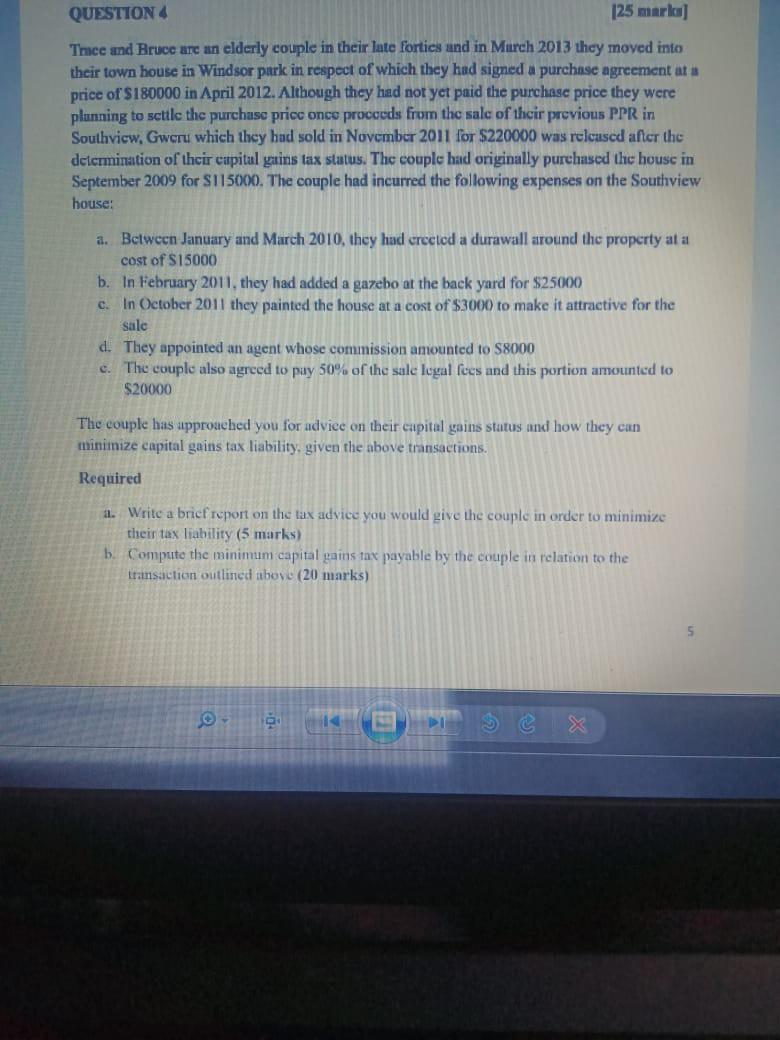

QUESTION [25 marl] Trace and Bruce are an elderly couple in their late forties and in March 2013 they moved into their town house in Windsor park in respect of which they had signed a purchase agreement at a price of $180000 in April 2012. Although they had not yet paid the purchase price they were planning to scule the purchase price once proceeds from the sale of their previous PPR in Southview, Gweru which they had sold in November 2011 for $220000 was relcased after the determination of their capital gains tax status. The couple had originally purchased the house in September 2009 for S115000. The couple had incurred the following expenses on the Southview house: a. Between January and March 2010, they had creclod a durawall around the property at a cost of S15000 b. In February 2011, they had added a gazebo at the back yard for $25000 c. In October 2011 they painted the house at a cost of $3000 to make it attractive for the sale d. They appointed an agent whose commission amounted to $8000 e. The couple also agreed to pay 50% of the sale legal foes and this portion amounted to $20000 The couple has approuched you for advice on their capital gains status and how they can minimize capital gains tax liability, given the above transactions. Required a. Write a brief report on the tax advice you would give the couple in order to minimize their tax liability (5 marks) b. Compute the minimum capital gains tax payable by the couple in relation to the transaction outlined tthove (20 marks)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock