Question: need quick response I will give you vote for your right answer 3) Tax Evasion: Consider an individual who wishes to limit his tax burden

need quick response I will give you vote for your right answer

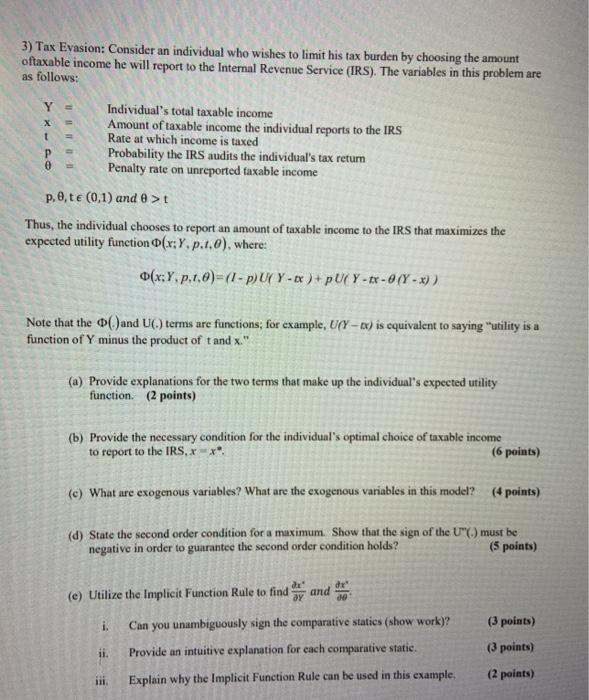

3) Tax Evasion: Consider an individual who wishes to limit his tax burden by choosing the amount oftaxable income he will report to the Internal Revenue Service (IRS). The variables in this problem are as follows: Individual's total taxable income Amount of taxable income the individual reports to the IRS Rate at which income is taxed Probability the IRS audits the individual's tax return Penalty rate on unreported taxable income p. 0t (0,1) and et Thus, the individual chooses to report an amount of taxable income to the IRS that maximizes the expected utility function (x:Y, p.1.0), where: (x: Y, p.1.0)=(1-P) UV Y - 1x )+pU( Y-te-0 (- x)) Y X t 0 ili Note that the o( )and UC) terms are functions, for example, U Y - ) is equivalent to saying "utility is a function of Y minus the product of t and x." (a) Provide explanations for the two terms that make up the individual's expected utility function. (2 points) (b) Provide necessary condition for the individual's optimal choice of taxable income to report to the IRS X-** (6 points) (e) What are exogenous variables? What are the exogenous variables in this model? (4 points) (d) State the second order condition for a maximum. Show that the sign of the U"() must be negative in order to guarantee the second order condition holds? (5 points) (e) Utilize the Implicit Function Rule to find and de i. Can you unambiguously sign the comparative staties (show work)? (3 points) ii. Provide an intuitive explanation for each comparative statie. (3 points) iii Explain why the Implicit Function Rule can be used in this example, (2 points)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock