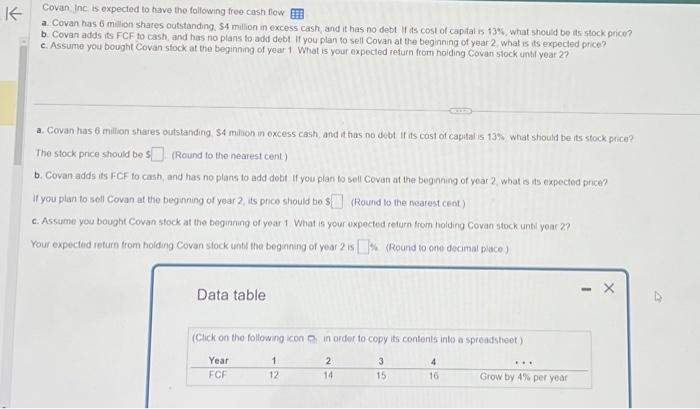

Question: need quick, will like! ty! Covan inc. is expected to have the following free cash flow a. Covan has 6m thion shares outstanding. $4 million

Covan inc. is expected to have the following free cash flow a. Covan has 6m thion shares outstanding. $4 million in excess cash and it has no debt if its cost of capital is, 13%, what should be its stock prica? b. Covan adds its FCF to cash, and has no plans to add debt If you plan to sell Covan at the beginning of year 2 . what is its expecled price? c. Assume you bought Covan stock at the beginning of year 1 . What is your expected refurn from holding Covan stock until year 2 ? a. Covan has 6 milion shares outstanding $4 milion in excess cash, and it has no debt if its cast of captal is 13% what should be its stock price? The stock price should bes (Round to the nearest cent) b. Covan-adds its FCF to cash, and has no plans to add dobt if you plan to sell Covan at the begining of year 2 , what is its expected phice? If you plan to sell Covan at the begining of year 2 , its price should be 3 (Round to ine nearest cent) c. Assume you bought Covan stock at the beginning of year 1 . What is your uxpected raturn from holding Covan stock until year 2 ? Your expected return from holding Covan slock unb the beginning of year 2 is (Round to one ducimal pluce)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts