Question: need right answer please don't copy (-)27.083 (+)20.750 Annual value Less interest on loan (81.250 x 1/3 cach) Share of income from let out property

need right answer please don't copy

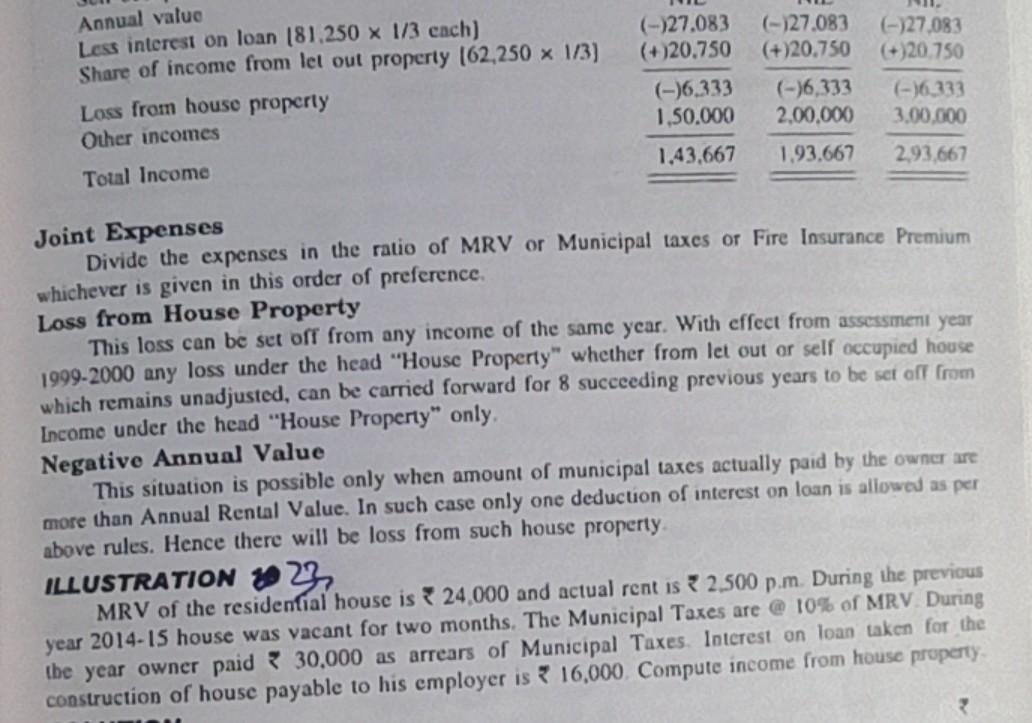

(-)27.083 (+)20.750 Annual value Less interest on loan (81.250 x 1/3 cach) Share of income from let out property (62.250 x 1/3) Loss from house properly Other incomes Total Income (-)27.083 (+)20.750 (-)6,333 1.50.000 (-)27.083 (+)20.750 (-)6,333 2,00.000 1.93.667 (-)6,333 3.00.000 1.43,667 2.93.667 Joint Expenses Divide the expenses in the ratio of MRV or Municipal taxes or Fire Insurance Premium whichever is given in this order of preference. Loss from House Property This loss can be set off from any income of the same year. With effect from assessment year 1999-2000 any loss under the head "House Property" whether from let out or self occupied house which remains unadjusted, can be carried forward for 8 succeeding previous years to be set off from Income under the head "House Property" only Negative Annual Value This situation is possible only when amount of municipal taxes actually paid by the owner are more than Annual Rental Value. In such case only one deduction of interest on loan is allowed as per above rules. Hence there will be loss from such house property ILLUSTRATION 2023, MRV of the residential house is 24,000 and actual rent is 2.500 p.m. During the previous year 2014-15 house was vacant for two months. The Municipal Taxes are @ 10% of MRV During the year owner paid * 30,000 as arrears of Municipal Taxes. Interest on loan taken for the construction of house payable to his employer is 16,000 Compute income from house propertyStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock