Question: need solution and formula please Fred asked two life insurance companies to give quotes on a 20-year deferred annuity (after a 5-year deferral period) that

need solution and formula please

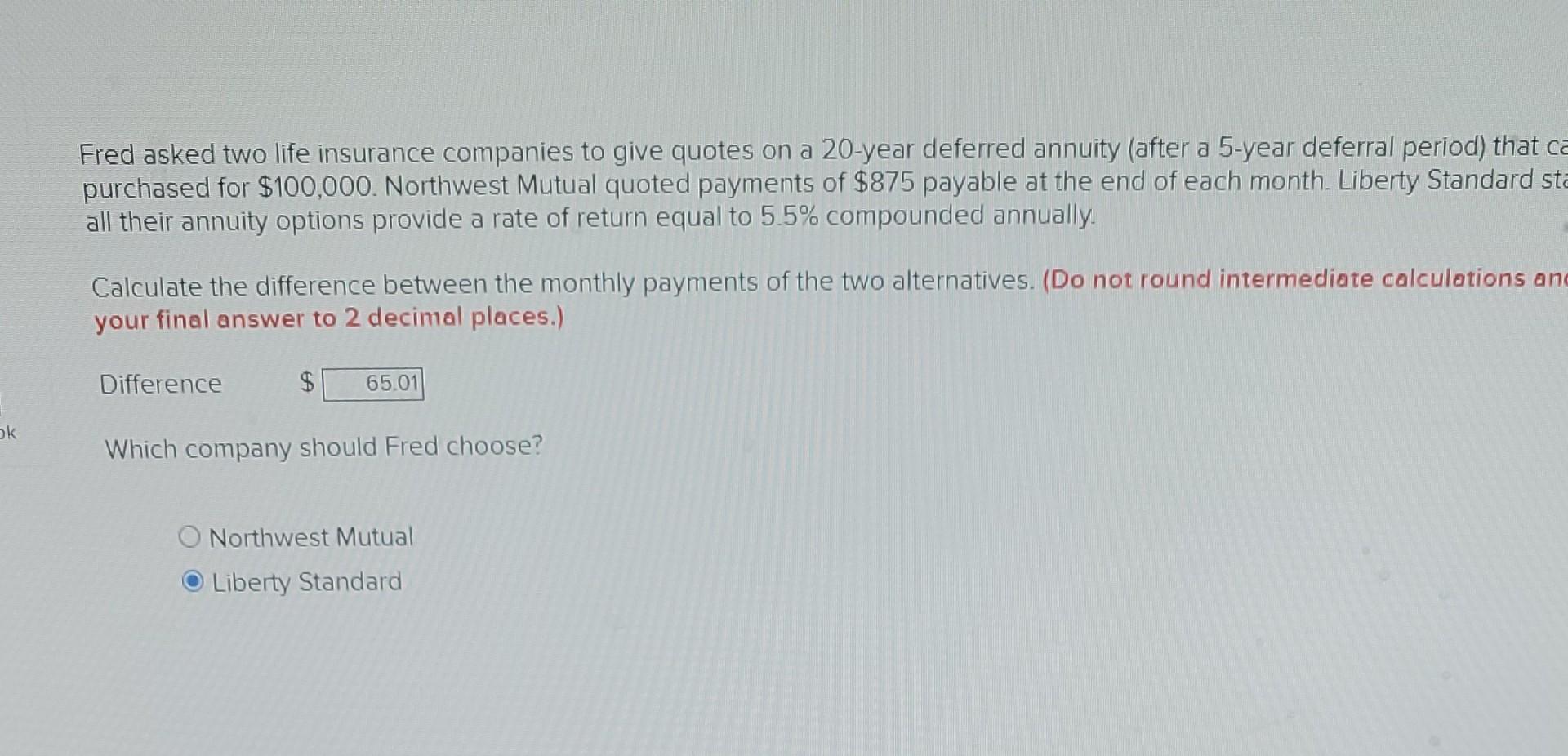

Fred asked two life insurance companies to give quotes on a 20-year deferred annuity (after a 5-year deferral period) that ca purchased for $100,000. Northwest Mutual quoted payments of $875 payable at the end of each month. Liberty Standard sta all their annuity options provide a rate of return equal to 5.5% compounded annually. Calculate the difference between the monthly payments of the two alternatives. (Do not round intermediate calculations and your final answer to 2 decimal places.) Difference 65.01 ok Which company should Fred choose? O Northwest Mutual Liberty Standard Fred asked two life insurance companies to give quotes on a 20-year deferred annuity (after a 5-year deferral period) that ca purchased for $100,000. Northwest Mutual quoted payments of $875 payable at the end of each month. Liberty Standard sta all their annuity options provide a rate of return equal to 5.5% compounded annually. Calculate the difference between the monthly payments of the two alternatives. (Do not round intermediate calculations and your final answer to 2 decimal places.) Difference 65.01 ok Which company should Fred choose? O Northwest Mutual Liberty Standard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts