Question: need solution with explanition please from qs 5-10 A subsidiary of General Electric (Voltare Energy) places in service electric generating and transmission equipment at a

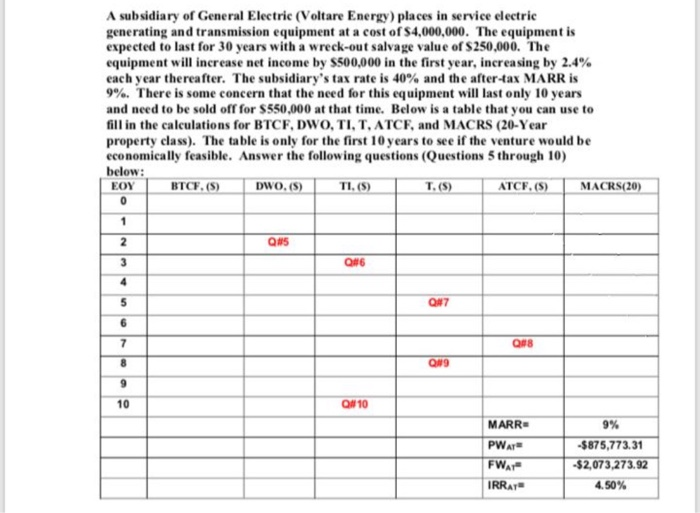

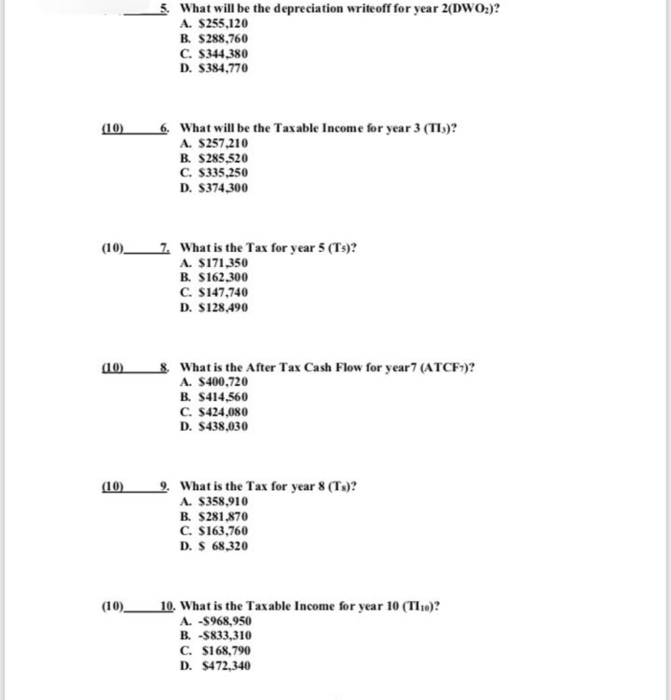

A subsidiary of General Electric (Voltare Energy) places in service electric generating and transmission equipment at a cost of $4,000,000. The equipment is expected to last for 30 years with a wreck-out salvage value of $250,000. The equipment will increase net income by $500,000 in the first year, increasing by 2.4% each year thereafter. The subsidiary's tax rate is 40% and the after-tax MARR is 9%. There is some concern that the need for this equipment will last only 10 years and need to be sold off for $550.000 at that time. Below is a table that you can use to fill in the calculations for BTCF, DWO, TI, T, ATCF, and MACRS (20-Year property class). The table is only for the first 10 years to see if the venture would be economically feasible. Answer the following questions (Questions through 10) below: EOY BTCF. (S) DWO. (S) TI.(S) T. (S) ATCF.(S) MACRS(20) MARR PWA 9% -$875,773.31 -$2,073,273.92 FWA IRRAT 4.50% What will be the depreciation writeoff for year 2(DWO2)? A. $255,120 B. $288,760 C. $344,380 D. $384,770 (10) 6. What will be the Taxable Income for year 3 (TI)? A. $257,210 B. $285,520 C. $335.250 D. $374,300 (10) 7. What is the Tax for year 5 (Ts)? A. $171,350 B. $162.300 C. $147,740 D. $128,490 (10) 8. What is the After Tax Cash Flow for year 7 (ATCF)? A. $400,720 B. $414,560 C. $424,080 D. $438.030 (10) 9. What is the Tax for year 8 (Ts)? A. $358,910 B. $281.870 C. $163,760 D. $ 68,320 (10)__ 10. What is the Taxable income for year 10 (T110)? A. -$968,950 B. -5833,310 C. $168,790 D. $472,340

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts