Question: Need some help with these problems, I will give a good rating and feedback to whoever helps Current assets Net fixed assets Total assets 2021

Need some help with these problems, I will give a good rating and feedback to whoever helps

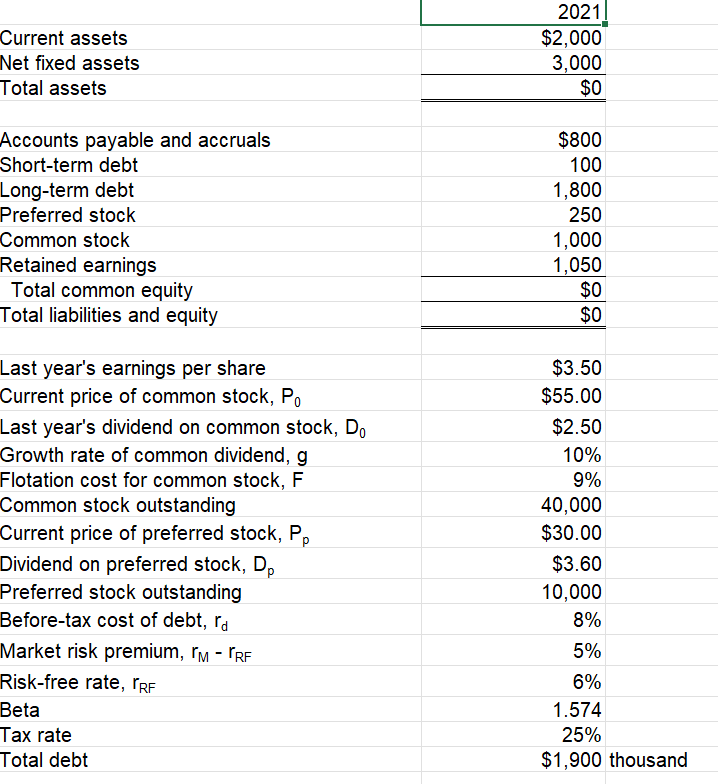

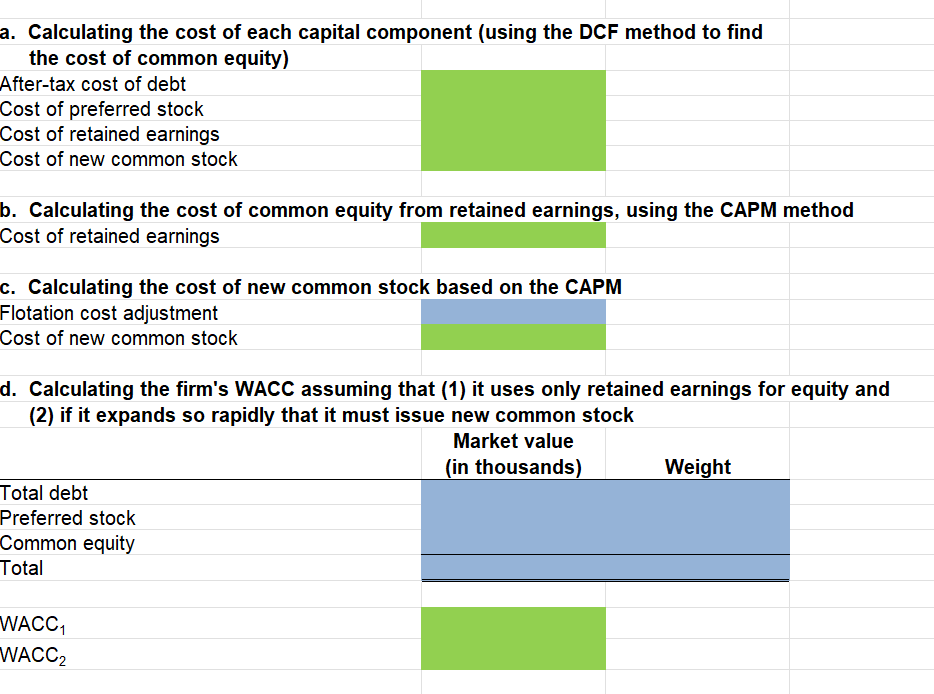

Current assets Net fixed assets Total assets 2021 $2,000 3,000 $0 Accounts payable and accruals Short-term debt Long-term debt Preferred stock Common stock Retained earnings Total common equity Total liabilities and equity $800 100 1,800 250 1,000 1,050 $0 $0 Last year's earnings per share Current price of common stock, Po Last year's dividend on common stock, D. Growth rate of common dividend, g Flotation cost for common stock, F Common stock outstanding Current price of preferred stock, Pp Dividend on preferred stock, De Preferred stock outstanding Before-tax cost of debt, ra Market risk premium, rm - IRF Risk-free rate, IRF Beta Tax rate Total debt $3.50 $55.00 $2.50 10% 9% 40,000 $30.00 $3.60 10,000 8% 5% 6% 1.574 25% $1,900 thousand a. Calculating the cost of each capital component (using the DCF method to find the cost of common equity) After-tax cost of debt Cost of preferred stock Cost of retained earnings Cost of new common stock b. Calculating the cost of common equity from retained earnings, using the CAPM method Cost of retained earnings C. Calculating the cost of new common stock based on the CAPM Flotation cost adjustment Cost of new common stock d. Calculating the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock Market value (in thousands) Weight Total debt Preferred stock Common equity Total WACC1 WACC2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts