Question: Need step by step in excel, somehow not getting a correct answer. Please. 6.3 Coca-Cola's (ticker symbol = KO) December ending prices (adjusted for stock

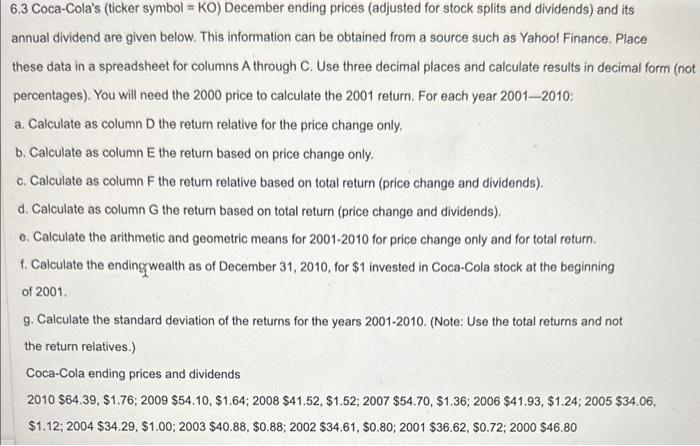

6.3 Coca-Cola's (ticker symbol = KO) December ending prices (adjusted for stock splits and dividends) and its annual dividend are given below. This information can be obtained from a source such as Yahool Finance. Place these data in a spreadsheet for columns A through C. Use three decimal places and calculate results in decimal form (n percentages). You will need the 2000 price to calculate the 2001 return. For each year 2001-2010: a. Calculate as column D the return relative for the price change only. b. Calculate as column E the return based on price change only. c. Calculate as column F the return relative based on total return (price change and dividends). d. Calculate as column G the return based on total return (price change and dividends). e. Calculate the arithmetic and geometric means for 2001-2010 for price change only and for total return. f. Calculate the endingwwealth as of December 31,2010 , for $1 invested in Coca-Cola stock at the beginning of 2001. g. Calculate the standard deviation of the returns for the years 2001-2010. (Note: Use the total returns and not the return relatives.) Coca-Cola ending prices and dividends 2010$64.39,$1.76;2009$54.10,$1.64;2008$41.52,$1.52;2007$54.70,$1.36;2006$41.93,$1.24;2005$34.06,$1.12;2004$34.29,$1.00;2003$40.88,$0.88;2002$34.61,$0.80;2001$36.62,$0.72;2000$46.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts