Question: Need the very last three boxes completed please. Requirement 1. Joumalize the transactions on the books of Quality Tire, Inc. assuming the net method is

Need the very last three boxes completed please.

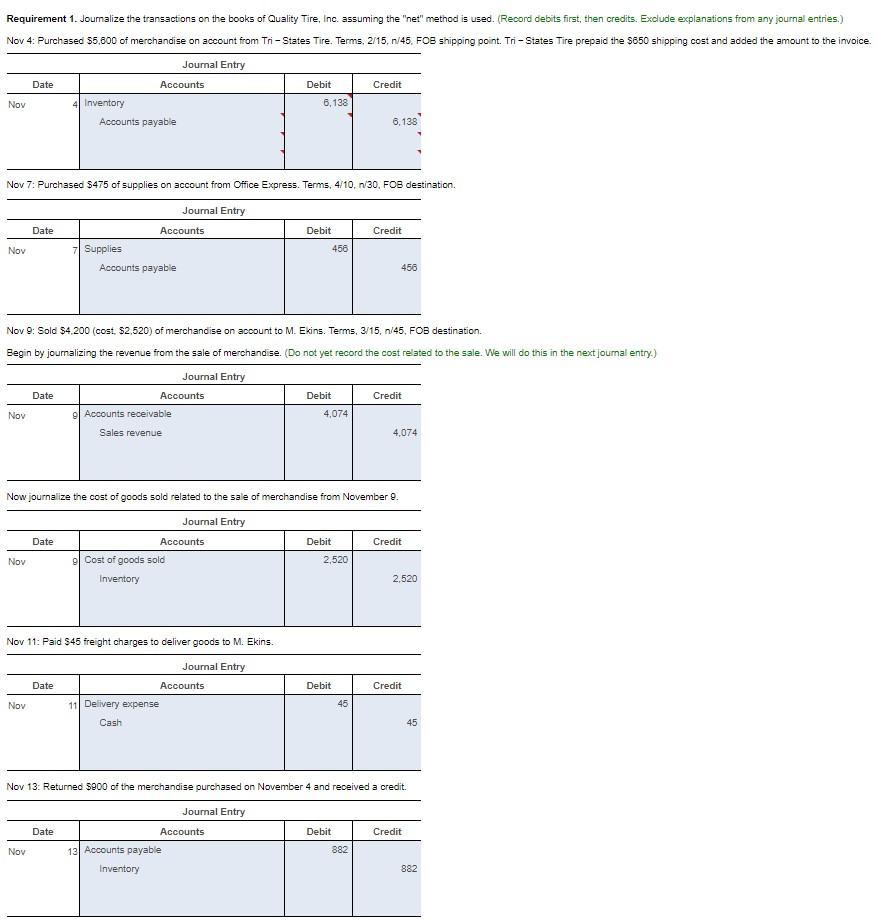

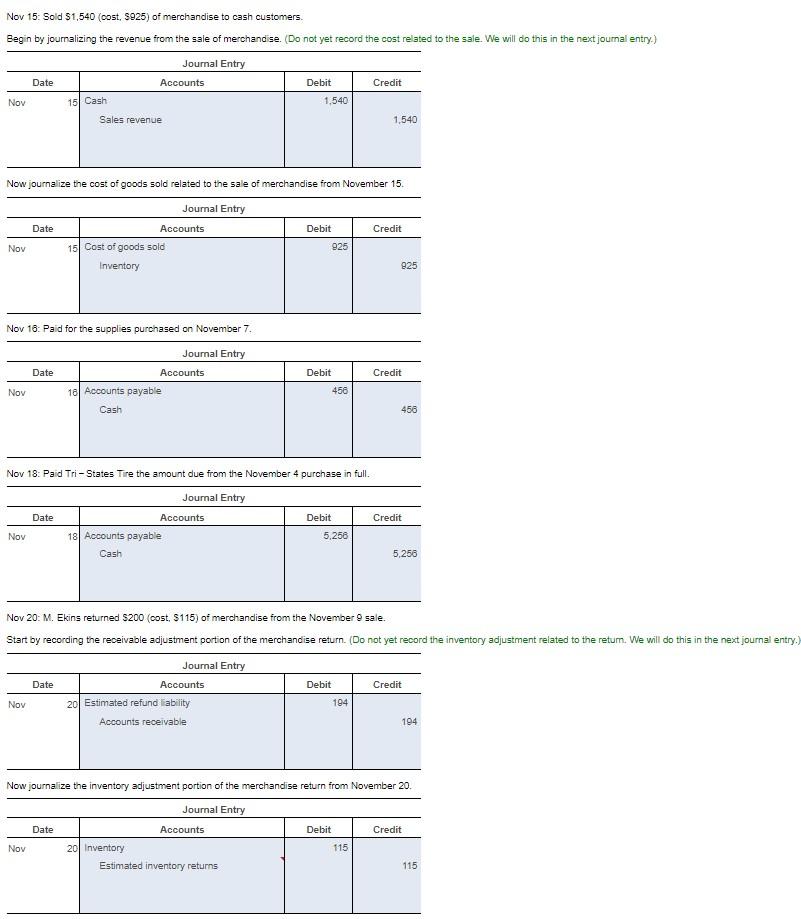

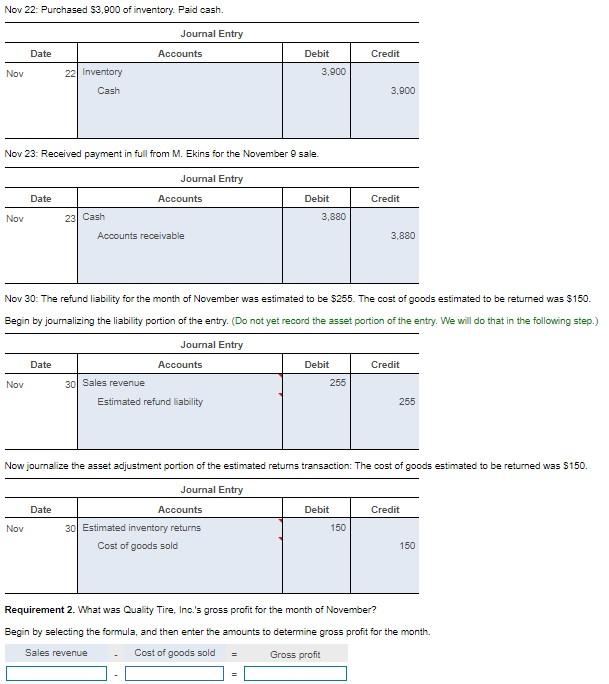

Requirement 1. Joumalize the transactions on the books of Quality Tire, Inc. assuming the "net" method is used. (Record debits first, then credits. Exclude explanations from any journal entries.) Nov 4: Purchased $5,600 of merchandise on account from Tri - States Tire. Terms, 2/15, n/45, FOB shipping point. Tri - States Tire prepaid the S650 shipping cost and added the amount to the invoi Nov 7: Purchased $475 of supplies on account from Office Express. Terms, 4/10, n/30, FOB destination. Nov 9 : Sold $4,200 (cost, $2,520) of merchandise on account to M. Ekins. Terms, 3/15, n/45, FOB destination. Begin by joumalizing the revenue from the sale of merchandise. (Do not yet record the cost related to the sale. We will do this in the next journal entry.) Now journalize the cost of goods sold related to the sale of merchandise from November 9. Nov 11: Paid $45 freight charges to deliver goods to M. Ekins. Nov 15: Sold $1,540 (cost, $925) of merchandise to cash customers. Begin by joumalizing the revenue from the sale of merchandise. (Do not yet record the cost related to the sale. We will do this in the next journal entry.) Now journalize the cost of goods sold related to the sale of merchandise from November 15. Nov 16: Paid for the supplies purchased on November 7. Nov 18: Paid Tri - States Tire the amount due from the November 4 purchase in full. Nov 20: M. Ekins returned $200 (cost, $115 ) of merchandise from the November 9 sale. Start by recording the receivable adjustment portion of the merchandise return. (Do not yet record the inventory adjustment related to the retum. We will do this in the next journal entry Now journalize the inventory adjustment portion of the merchandise return from November 20 . Nov 22: Purchased $3,900 of inventory. Paid cash. Nov 23: Received payment in full from M. Ekins for the November 9 sale. Nov 30: The refund liability for the month of November was estimated to be $255. The cost of goods estimated to be returned was $150. Begin by journalizing the liability portion of the entry. (Do not yet record the asset portion of the entry. We will do that in the following step.) Now journalize the asset adjustment portion of the estimated retums transaction: The cost of goods estimated to be returned was $150. Requirement 2. What was Quality Tire, Inc.'s gross profit for the month of November? Begin by selecting the formula, and then enter the amounts to determine gross profit for the month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts