Question: q22 pls provide Complete solution. thankyou so much. Question 22 1 pts The following information is provided regarding an equipment purchased at the beginning of

q22 pls provide Complete solution. thankyou so much.

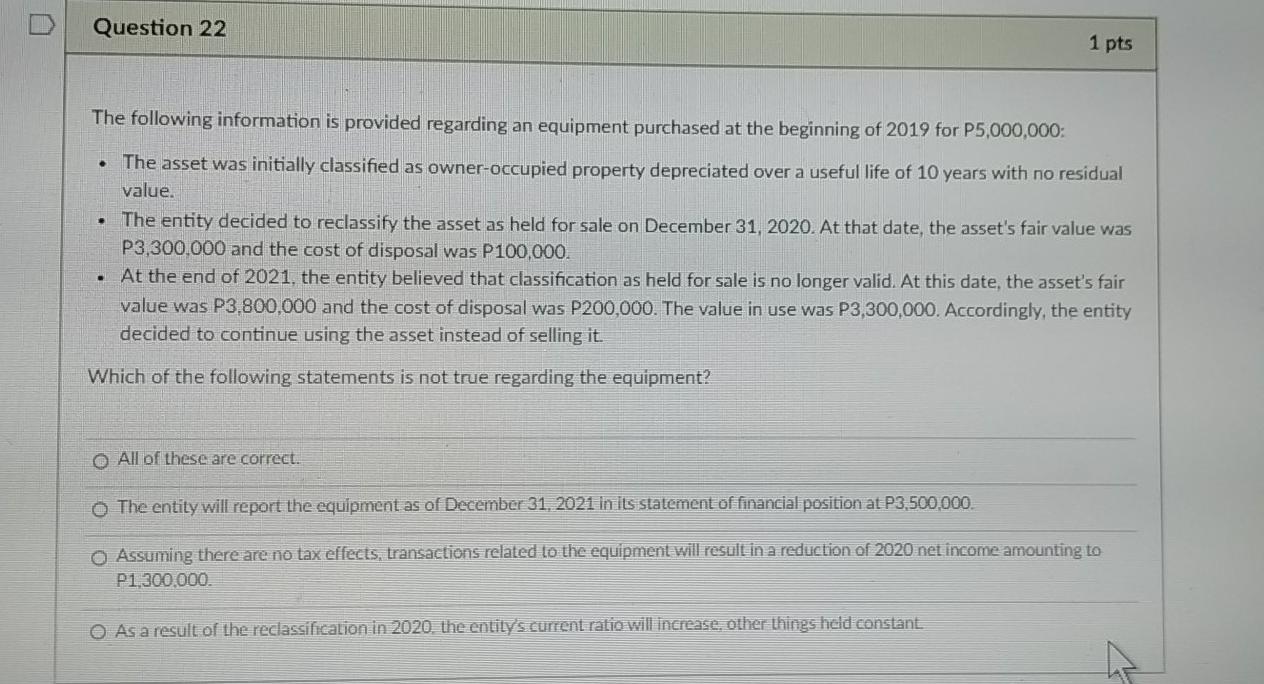

Question 22 1 pts The following information is provided regarding an equipment purchased at the beginning of 2019 for P5,000,000: . The asset was initially classified as owner-occupied property depreciated over a useful life of 10 years with no residual value. The entity decided to reclassify the asset as held for sale on December 31, 2020. At that date, the asset's fair value was P3,300,000 and the cost of disposal was P100,000. . At the end of 2021, the entity believed that classification as held for sale is no longer valid. At this date, the asset's fair value was P3,800,000 and the cost of disposal was P200,000. The value in use was P3,300,000. Accordingly, the entity decided to continue using the asset instead of selling it Which of the following statements is not true regarding the equipment? All of these are correct. o The entity will report the equipment as of December 31, 2021 in its statement of financial position at P3,500,000. o Assuming there are no tax effects, transactions related to the equipment will result in a reduction of 2020 net income amounting to P1,300.000. As a result of the reclassification in 2020. the entily's current ratio will increase, other things held constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts