Question: need this with work shown 6. Answer the below questions. (a) Why do rating agencies assign a different rating to the debt of a sovereign

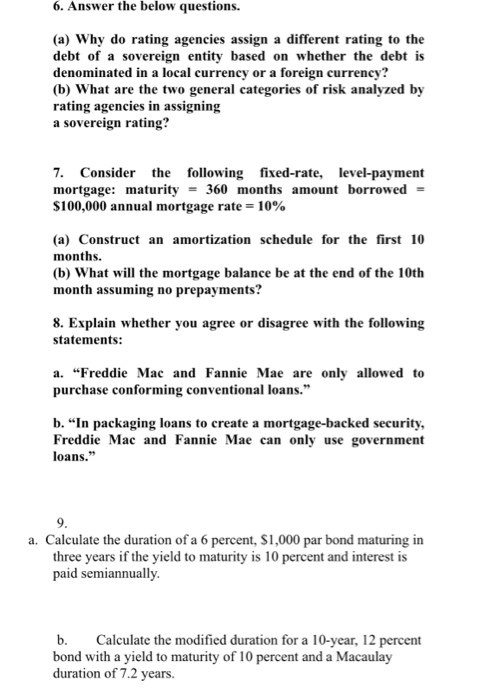

6. Answer the below questions. (a) Why do rating agencies assign a different rating to the debt of a sovereign entity based on whether the debt is denominated in a local currency or a foreign currency? (b) What are the two general categories of risk analyzed by rating agencies in assigning a sovereign rating? 7. Consider the following fixed-rate, level-payment mortgage: maturity360 months amount borrowed $100,000 annual mortgage rate 10% (a) Construct an amortization schedule for the first 10 months (b) What will the mortgage balance be at the end of the 10th month assuming no prepayments? 8. Explain whether you agree or disagree with the following statements: a. "Freddie Mac and Fannie Mae are only allowed to purchase conforming conventional loans." b. "In packaging loans to create a mortgage-backed security Freddie Mac and Fannie Mae can only use government loans. a. Calculate the duration of a 6 percent, S1,000 par bond maturing in three years if the yield to maturity is 10 percent and interest is paid semiannually b. Calculate the modified duration for a 10-year, 12 percent bond with a yield to maturity of 10 percent and a Macaulay duration of 7.2 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts