Question: Need to see these worked out for a study guide Premium MIZABLE LDER 15. The standard deviation of return on investment A is. 10 while

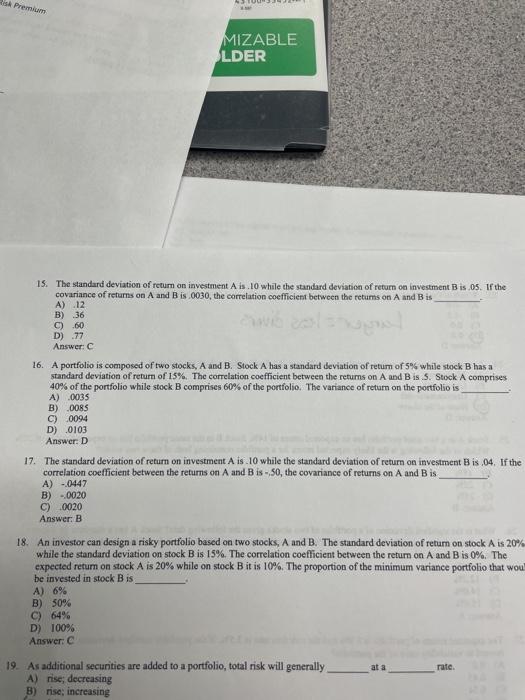

Premium MIZABLE LDER 15. The standard deviation of return on investment A is. 10 while the standard deviation of return on investment B is.05. If the covariance of returns on A and B is.0030, the correlation coefficient between the returns on A and B is A) 12 B) 36 C) 60 D) 77 Answer: chavio salvo 16. A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 5% while stock B has a standard deviation of return of 15%. The correlation coefficient between the returns on A and B is S. Stock A comprises 40% of the portfolio while stock B comprises 60% of the portfolio. The variance of return on the portfolio is A) 0035 B) .0085 C) 0094 D) .0103 Answer: D 17. The standard deviation of return on investment A is 10 while the standard deviation of return on investment Bis .04. If the correlation coefficient between the returns on A and B is - 50, the covariance of returns on A and B is A) - 0447 B)-0020 C) 0020 Answer: B 18. An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 20% while the standard deviation on stock Bis 15%. The correlation coefficient between the return on A and B is 0%. The expected return on stock A is 20% while on stock B it is 10%. The proportion of the minimum variance portfolio that wou be invested in stock B is A) 6% B) 50% C) 64% D) 100% Answer: at a rate 19. As additional securities are added to a portfolio, total risk will generally A) rise; decreasing B) rise; increasing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts