Question: Need to understand how to get to the answer for the variance question please Use the table from Question 1. If the returns of assets

Need to understand how to get to the answer for the variance question please

Need to understand how to get to the answer for the variance question please

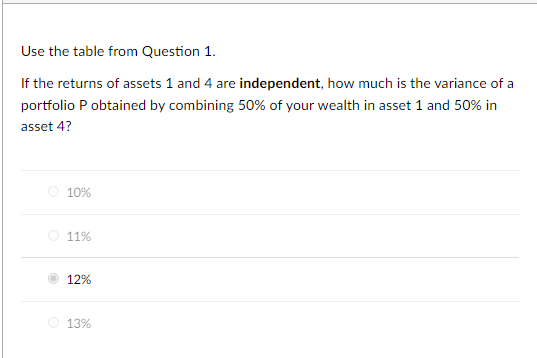

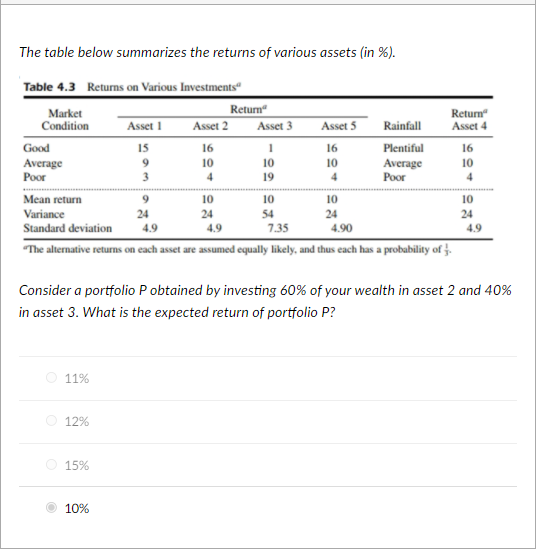

Use the table from Question 1. If the returns of assets 1 and 4 are independent, how much is the variance of a portfolio Pobtained by combining 50% of your wealth in asset 1 and 50% in asset 4? 10% 11% 12% 13% The table below summarizes the returns of various assets (in %). Return Asset 4 Table 4.3 Returns on Various Investments Market Return Condition Asset 1 Asset 2 Asset 3 Asset 5 Rainfall Good 15 16 1 16 Plentiful Average 10 10 Average Poor 4 Poor Mean return 9 10 10 Variance 24 24 54 24 Standard deviation 4.9 4.9 7.35 4.90 "The alternative returns on each asset are assumed equally likely, and thus each has a probability of 9 3 10 19 16 10 4 4 10 10 24 4.9 Consider a portfolio Pobtained by investing 60% of your wealth in asset 2 and 40% in asset 3. What is the expected return of portfolio P? 11% 12% 15% 10% Use the table from Question 1. If the returns of assets 1 and 4 are independent, how much is the variance of a portfolio Pobtained by combining 50% of your wealth in asset 1 and 50% in asset 4? 10% 11% 12% 13% The table below summarizes the returns of various assets (in %). Return Asset 4 Table 4.3 Returns on Various Investments Market Return Condition Asset 1 Asset 2 Asset 3 Asset 5 Rainfall Good 15 16 1 16 Plentiful Average 10 10 Average Poor 4 Poor Mean return 9 10 10 Variance 24 24 54 24 Standard deviation 4.9 4.9 7.35 4.90 "The alternative returns on each asset are assumed equally likely, and thus each has a probability of 9 3 10 19 16 10 4 4 10 10 24 4.9 Consider a portfolio Pobtained by investing 60% of your wealth in asset 2 and 40% in asset 3. What is the expected return of portfolio P? 11% 12% 15% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts