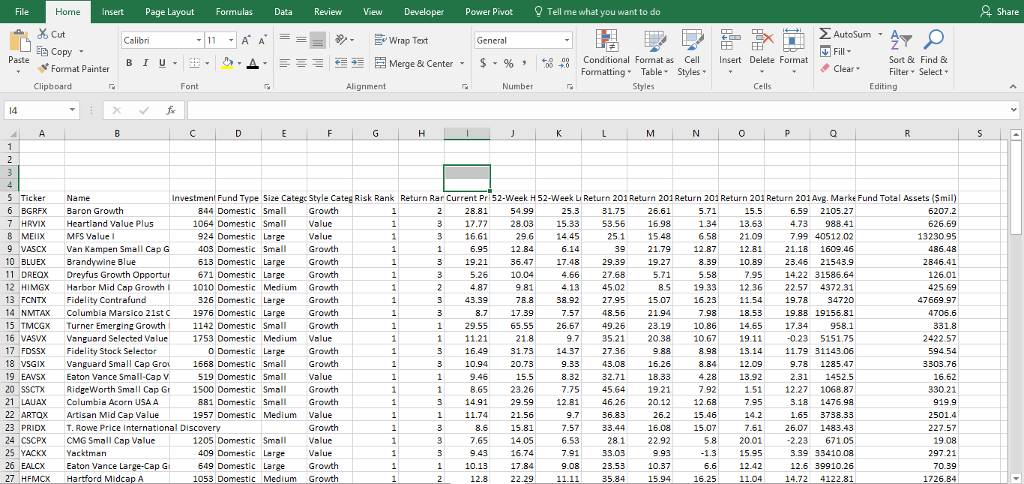

Question: Need to use advanced filter option to filter the list and copy to different cell to show all of this together in one filtered table:

Need to use advanced filter option to filter the list and copy to different cell to show all of this together in one filtered table: cells in column N greater than cells in column M and less than cells in column O or cells in the top 15 % of column P.

I dont want a formula like =IF($M$6:$B$27

I need a combination of advanced filters (the option that is under the data tab)

| Ticker | Name | Investment Value ($000) | Fund Type | Size Category | Style Category | Risk Rank | Return Rank | Current Price | 52-Week High | 52-Week Low | Return 2010(%) | Return 2011 (%) | Return 2012(%) | Return 2013 (%) | Return 2014 (%) | Avg. Market Cap ($mil) | Fund Total Assets ($mil) |

| BGRFX | Baron Growth | 844 | Domestic | Small | Growth | 1 | 2 | 28.81 | 54.99 | 25.3 | 31.75 | 26.61 | 5.71 | 15.5 | 6.59 | 2105.27 | 6207.2 |

| HRVIX | Heartland Value Plus | 1064 | Domestic | Small | Value | 1 | 3 | 17.77 | 28.03 | 15.33 | 53.56 | 16.98 | 1.34 | 13.63 | 4.73 | 988.41 | 626.69 |

| MEIIX | MFS Value I | 924 | Domestic | Large | Value | 1 | 3 | 16.61 | 29.6 | 14.45 | 25.1 | 15.48 | 6.58 | 21.09 | 7.99 | 40512.02 | 13230.95 |

| VASCX | Van Kampen Small Cap Growth A | 403 | Domestic | Small | Growth | 1 | 1 | 6.95 | 12.84 | 6.14 | 39 | 21.79 | 12.87 | 12.81 | 21.18 | 1609.46 | 486.48 |

| BLUEX | Brandywine Blue | 613 | Domestic | Large | Growth | 1 | 3 | 19.21 | 36.47 | 17.48 | 29.39 | 19.27 | 8.39 | 10.89 | 23.46 | 21543.9 | 2846.41 |

| DREQX | Dreyfus Growth Opportunity Z | 671 | Domestic | Large | Growth | 1 | 3 | 5.26 | 10.04 | 4.66 | 27.68 | 5.71 | 5.58 | 7.95 | 14.22 | 31586.64 | 126.01 |

| HIMGX | Harbor Mid Cap Growth Inv | 1010 | Domestic | Medium | Growth | 1 | 2 | 4.87 | 9.81 | 4.13 | 45.02 | 8.5 | 19.33 | 12.36 | 22.57 | 4372.31 | 425.69 |

| FCNTX | Fidelity Contrafund | 326 | Domestic | Large | Growth | 1 | 3 | 43.39 | 78.8 | 38.92 | 27.95 | 15.07 | 16.23 | 11.54 | 19.78 | 34720 | 47669.97 |

| NMTAX | Columbia Marsico 21st Century A | 1976 | Domestic | Large | Growth | 1 | 3 | 8.7 | 17.39 | 7.57 | 48.56 | 21.94 | 7.98 | 18.53 | 19.88 | 19156.81 | 4706.6 |

| TMCGX | Turner Emerging Growth Investor | 1142 | Domestic | Small | Growth | 1 | 1 | 29.55 | 65.55 | 26.67 | 49.26 | 23.19 | 10.86 | 14.65 | 17.34 | 958.1 | 331.8 |

| VASVX | Vanguard Selected Value | 1753 | Domestic | Medium | Value | 1 | 1 | 11.21 | 21.8 | 9.7 | 35.21 | 20.38 | 10.67 | 19.11 | -0.23 | 5151.75 | 2422.57 |

| FDSSX | Fidelity Stock Selector | 0 | Domestic | Large | Growth | 1 | 3 | 16.49 | 31.73 | 14.37 | 27.36 | 9.88 | 8.98 | 13.14 | 11.79 | 31143.06 | 594.54 |

| VSGIX | Vanguard Small Cap Growth Index Instl | 1668 | Domestic | Small | Growth | 1 | 3 | 10.94 | 20.73 | 9.33 | 43.08 | 16.26 | 8.84 | 12.09 | 9.78 | 1285.47 | 3303.76 |

| EAVSX | Eaton Vance Small-Cap Value A | 519 | Domestic | Small | Value | 1 | 1 | 9.46 | 15.5 | 8.32 | 32.71 | 18.33 | 4.28 | 13.92 | 2.31 | 1452.5 | 16.62 |

| SSCTX | RidgeWorth Small Cap Growth Stock I | 1500 | Domestic | Small | Growth | 1 | 1 | 8.65 | 23.26 | 7.75 | 45.64 | 19.21 | 7.92 | 1.51 | 12.27 | 1068.87 | 330.21 |

| LAUAX | Columbia Acorn USA A | 881 | Domestic | Small | Growth | 1 | 3 | 14.91 | 29.59 | 12.81 | 46.26 | 20.12 | 12.68 | 7.95 | 3.18 | 1476.98 | 919.9 |

| ARTQX | Artisan Mid Cap Value | 1957 | Domestic | Medium | Value | 1 | 1 | 11.74 | 21.56 | 9.7 | 36.83 | 26.2 | 15.46 | 14.2 | 1.65 | 3738.33 | 2501.4 |

| PRIDX | T. Rowe Price International Discovery | Growth | 1 | 3 | 8.6 | 15.81 | 7.57 | 33.44 | 16.08 | 15.07 | 7.61 | 26.07 | 1483.43 | 227.57 | |||

| CSCPX | CMG Small Cap Value | 1205 | Domestic | Small | Value | 1 | 3 | 7.65 | 14.05 | 6.53 | 28.1 | 22.92 | 5.8 | 20.01 | -2.23 | 671.05 | 19.08 |

| YACKX | Yacktman | 409 | Domestic | Large | Value | 1 | 3 | 9.43 | 16.74 | 7.91 | 33.03 | 9.93 | -1.3 | 15.95 | 3.39 | 33410.08 | 297.21 |

| EALCX | Eaton Vance Large-Cap Growth A | 649 | Domestic | Large | Growth | 1 | 1 | 10.13 | 17.84 | 9.08 | 23.53 | 10.37 | 6.6 | 12.42 | 12.6 | 39910.26 | 70.39 |

| HFMCX | Hartford Midcap A | 1053 | Domestic | Medium | Growth | 1 | 2 | 12.8 | 22.29 | 11.11 | 35.84 | 15.94 | 16.25 | 11.04 | 14.72 | 4122.81 | 1726.84 |

| LSAIX | Loomis Sayles Mid Cap Growth Instl | 330 | Domestic | Medium | Growth | 1 | 1 | 15.97 | 30.88 | 14.58 | 40.09 | 19.35 | 15.41 | 7 | 39.7 | 4447.52 | 91.46 |

| BMCIX | BlackRock U.S. Opportunities Instl | 1072 | Domestic | Medium | Growth | 1 | 1 | 22.45 | 38.81 | 19.36 | 47.79 | 18.33 | 14.62 | 18.79 | 21.35 | 3453.92 | 862.33 |

| JAOSX | Janus Overseas | 1611 | Foreign | Large | Growth | 1 | 3 | 21.84 | 61.22 | 19.95 | 36.79 | 18.58 | 32.39 | 47.21 | 27.76 | 6114.01 | 4345.36 |

| NBMVX | Neuberger Berman Small Cap Growth Adv | 937 | Foreign | Small | Growth | 1 | 1 | 22.15 | 56.2 | 21.11 | 65.29 | 23.76 | 27.89 | 27.65 | 16.57 | 1215.82 | 1372.79 |

| PITIX | Principal International Growth Inst | 1807 | Foreign | Large | Growth | 1 | 1 | 6.09 | 14.55 | 5.67 | 38.97 | 22.78 | 22.33 | 24.35 | 12.5 | 18803.26 | 1243.38 |

| VINEX | Vanguard International Explorer | 751 | Foreign | Small | Growth | 1 | 1 | 8.57 | 22.89 | 8.1 | 57.37 | 31.77 | 20.49 | 30.34 | 5.15 | 1446.82 | 1079.24 |

| LAIAX | Columbia Acorn International A | 1744 | Foreign | Medium | Growth | 1 | 1 | 20.23 | 47.97 | 18.85 | 46.94 | 28.91 | 21.42 | 34.16 | 16.9 | 1494.5 | 2723.66 |

| SGOVX | First Eagle Overseas A | 1661 | Foreign | Small | Value | 1 | 2 | 16.51 | 27.81 | 15.6 | 41.41 | 21.83 | 16.92 | 22.29 | 8.39 | 3879.38 | 6002.13 |

| OAKIX | Oakmark International I | 1005 | Foreign | Large | Large | 1 | 2 | 11.36 | 26.35 | 10.03 | 38.04 | 19.09 | 14.12 | 30.6 | -0.51 | 14364.52 | 2771.76 |

| FPPFX | FPA Perennial | 1365 | Domestic | Medium | Growth | 2 | 2 | 19.36 | 38.53 | 17.18 | 37.89 | 16.25 | 12.81 | 4.06 | 7.1 | 2193.34 | 214.58 |

| SGGAX | DWS Large Company Growth A | 141 | Domestic | Large | Growth | 2 | 3 | 19.4 | 30.61 | 17.38 | 24.71 | 4.22 | 7.93 | 6.93 | 12.43 | 38715.06 | 189.3 |

| CSIEX | Calvert Social Investment Equity A | 1511 | Domestic | Large | Growth | 2 | 2 | 22.15 | 41.08 | 21.33 | 22.31 | 6.69 | 4.16 | 10.16 | 9.94 | 25260.86 | 836.36 |

| RSQCX | Royce Special Equity Consult | 765 | Domestic | Small | Value | 2 | 2 | 13.44 | 20.78 | 12.09 | 35.5 | 12.66 | -2.16 | 12.75 | 3.63 | 713.42 | 455.74 |

| VSMCX | Van Kampen Small Cap Value C | 190 | Domestic | Small | Value | 2 | 2 | 9.18 | 16.16 | 7.74 | 38.14 | 16.2 | 6.98 | 24.31 | -0.98 | 1053.17 | 364.31 |

| TRMCX | T. Rowe Price Mid-Cap Value | 558 | Domestic | Medium | Value | 2 | 1 | 13.88 | 26.39 | 11.8 | 39 | 20.56 | 7.73 | 20.24 | 0.6 | 5258.57 | 4844.37 |

| JORNX | Janus Orion | 1374 | Domestic | Medium | Growth | 2 | 1 | 5.74 | 13.44 | 5.02 | 43.81 | 14.9 | 20.93 | 18.64 | 32.38 | 13136.34 | 2687.07 |

| ATHAX | American Century Heritage A | 175 | Domestic | Medium | Growth | 2 | 3 | 11.04 | 22.87 | 9.41 | 21.24 | 6.84 | 21.9 | 16.81 | 45.37 | 7176.55 | 1612.05 |

| LSGIX | Loomis Sayles Value Y | 0 | Domestic | Large | Value | 2 | 1 | 13.58 | 22.43 | 11.58 | 26.24 | 15.12 | 12.8 | 24.75 | 6.17 | 44593.06 | 338.02 |

| NCLEX | Nicholas Limited Edition I | 280 | Domestic | Small | Growth | 2 | 2 | 12.67 | 22.63 | 11.09 | 39.55 | 13.94 | 7.78 | 6.38 | 11.2 | 1150.15 | 123.1 |

| JSCVX | Janus Small Cap Value Inv | 424 | Domestic | Small | Value | 2 | 2 | 16.22 | 27.48 | 13.96 | 36.78 | 13.57 | 8.9 | 12.37 | 2.97 | 1330.11 | 1068.62 |

| CHASX | Chase Growth | 0 | Domestic | Large | Growth | 2 | 3 | 13.53 | 23.19 | 12.47 | 17.88 | 16.91 | 11.37 | 1.41 | 20.04 | 48207.13 | 452.78 |

| MERDX | Meridian Growth | 1668 | Domestic | Medium | Growth | 2 | 1 | 24.63 | 43.26 | 21 | 47.9 | 14.47 | 0.33 | 15.81 | 5.4 | 3316.85 | 1039.55 |

| WAAEX | Wasatch Small Cap Growth | 765 | Domestic | Small | Growth | 2 | 1 | 18.83 | 41.04 | 16.32 | 37.43 | 13.36 | 5.14 | 8.4 | 8.36 | 1222.52 | 522.96 |

| LOMMX | CGM Mutual | 560 | Domestic | Large | Growth | 2 | 1 | 21.22 | 38.6 | 19.77 | 39.74 | 10.92 | 14.63 | 5.5 | 38.49 | 64822.96 | 458.06 |

| PVFAX | Paradigm Value | 516 | Domestic | Small | Value | 2 | 1 | 30.78 | 52.52 | 26.7 | 60.89 | 32.09 | 19.49 | 19.3 | 5.03 | 917.27 | 85.53 |

| EKJAX | Evergreen Large Company Growth A | 1037 | Domestic | Large | Growth | 2 | 1 | 5.5 | 8.48 | 4.86 | 27.57 | 4.68 | 6.62 | 7.38 | 10.57 | 38483.78 | 229.2 |

| BUFSX | Buffalo Small Cap | 257 | Domestic | Small | Growth | 2 | 1 | 14.99 | 28.2 | 12.42 | 51.23 | 28.82 | 3.22 | 13.95 | -0.33 | 1127.17 | 1067.05 |

| HRSCX | Eagle Small Cap Growth A | 399 | Domestic | Small | Growth | 2 | 2 | 19.39 | 39.58 | 16.55 | 40.43 | 16.84 | 1.43 | 17.66 | 7.07 | 884.72 | 235.47 |

| LACAX | Columbia Acorn A | 1382 | Domestic | Medium | Growth | 2 | 3 | 16 | 31.83 | 13.59 | 44.85 | 21.05 | 12.76 | 14.13 | 7.39 | 1900.18 | 10666.22 |

| MSSCX | Managers Small Cap | 259 | Domestic | Small | Growth | 2 | 2 | 10.14 | 17.39 | 8.65 | 44.3 | 10.59 | 10.8 | 15.82 | 7.46 | 806.06 | 43.72 |

| TASVX | Target Small Capitalization Value | 1784 | Domestic | Small | Value | 2 | 3 | 12.59 | 21.14 | 10.71 | 47.1 | 24.02 | 10.1 | 17.72 | 0.52 | 1617.49 | 368.69 |

| HRSVX | Heartland Select Value | 1692 | Domestic | Medium | Value | 2 | 2 | 16.72 | 30.15 | 14.31 | 35.66 | 17.02 | 13.49 | 16.69 | 4.02 | 5136.41 | 259.02 |

| FDIVX | Fidelity Diversified International | 750 | Foreign | Small | Growth | 1 | 2 | 18.99 | 43.78 | 17.33 | 42.38 | 19.66 | 17.23 | 22.52 | 16.03 | 22169.93 | 29295.62 |

| DODFX | Dodge & Cox International Stock | 978 | Foreign | Large | Value | 2 | 2 | 21.56 | 50.53 | 19.33 | 49.42 | 32.46 | 16.75 | 28.01 | 11.71 | 24565.33 | 24959.63 |

| MIDAX | MFS International New Discovery A | 694 | Foreign | Small | Growth | 1 | 3 | 12.12 | 30.86 | 11.18 | 48.57 | 24.3 | 20.21 | 26.85 | 8.87 | 3496.86 | 1779.56 |

| EPIEX | Epoch International Small Cap Inst | 463 | Foreign | Small | Growth | 2 | 2 | 11.16 | 28.18 | 10.55 | 42.1 | 20.5 | 14.3 | 38.26 | 14.17 | 2338.85 | 150.95 |

| MGRAX | MFS International Growth A | 394 | Foreign | Large | Growth | 2 | 3 | 14.14 | 30.41 | 13.05 | 36.03 | 17.54 | 13.95 | 25.72 | 15.9 | 19950.53 | 669.97 |

| HAINX | Harbor International Instl | 1178 | Foreign | Large | Value | 2 | 2 | 35.59 | 78.85 | 31.95 | 40.95 | 17.97 | 20.84 | 32.69 | 21.82 | 30865.06 | 17129.34 |

| OIGYX | Oppenheimer International Growth Y | 1185 | Foreign | Large | Growth | 2 | 2 | 16.07 | 32.62 | 14.88 | 32.7 | 22.5 | 21.1 | 30.18 | 12.93 | 11036.89 | 1926.12 |

| ARTIX | Artisan International Inv | 384 | Foreign | Large | Growth | 2 | 3 | 13.74 | 35.84 | 12.39 | 29.14 | 17.76 | 16.27 | 25.56 | 19.73 | 24858.55 | 6493.9 |

| TAVIX | Third Avenue International Value | 275 | Foreign | Medium | Value | 2 | 3 | 10.59 | 23.6 | 9.91 | 54.68 | 27.7 | 18 | 17.13 | 3.36 | 2788 | 1071.29 |

| TBGVX | Tweedy, Browne Global Value | 1781 | Foreign | Small | Value | 2 | 2 | 17.52 | 33.67 | 17.13 | 24.93 | 20.01 | 15.42 | 20.14 | 7.54 | 10008.71 | 3846.05 |

| VWIGX | Vanguard International Growth | 753 | Foreign | Large | Value | 2 | 3 | 11.87 | 28.77 | 10.74 | 34.45 | 18.95 | 15 | 25.92 | 15.98 | 24094.44 | 11032.57 |

| JALCX | James Equity | 1114 | Domestic | Medium | Value | 3 | 1 | 5.77 | 12.12 | 5.47 | 26.63 | 22.1 | 15.07 | 16.19 | 3.62 | 5665.35 | 9.77 |

| JATTX | Janus Triton | 0 | Domestic | Small | Growth | 3 | 1 | 7.7 | 16.47 | 6.38 | 28.1 | 18.1 | 3.5 | 15.85 | 20.69 | 1326.57 | 122.68 |

| BRWIX | Brandywine | 1015 | Domestic | Medium | Growth | 3 | 2 | 19.45 | 38.24 | 17.7 | 31.46 | 13.11 | 14.39 | 11.09 | 21.8 | 5431.71 | 2442.22 |

| BEGRX | Mutual Beacon Z | 718 | Domestic | Large | Value | 3 | 2 | 8.67 | 17.62 | 7.69 | 29.44 | 14.52 | 9.25 | 20.98 | 3.03 | 17064.97 | 4141.34 |

| VEIPX | Vanguard Equity-Income | 1802 | Domestic | Large | Value | 3 | 3 | 15.9 | 26.86 | 13.75 | 25.14 | 13.57 | 4.37 | 20.62 | 4.86 | 46627.72 | 3736.08 |

| PRFDX | T. Rowe Price Equity Income | 1012 | Domestic | Large | Value | 3 | 1 | 16.58 | 30.65 | 14 | 25.78 | 15.05 | 4.26 | 19.14 | 3.3 | 30709.74 | 15323.74 |

| LSBAX | Lord Abbett Small-Cap Blend A | 138 | Domestic | Small | Growth | 3 | 3 | 10.04 | 16.91 | 8.58 | 52.35 | 20.84 | 12.91 | 5.95 | 9.75 | 1058.53 | 1053.98 |

| FBRVX | FBR Focus | 502 | Domestic | Medium | Growth | 3 | 1 | 33.77 | 55.88 | 27.98 | 45.77 | 30.67 | 2.31 | 28.49 | 2.3 | 2219.5 | 661.36 |

| BARAX | Baron Asset | 577 | Domestic | Medium | Growth | 3 | 1 | 35.23 | 67.93 | 30.65 | 27.34 | 27.13 | 12.46 | 14.64 | 10.13 | 4963.08 | 3741.2 |

| BCSIX | Brown Capital Mgmt Small Co Instl | 1493 | Domestic | Small | Growth | 3 | 1 | 22.66 | 40.77 | 20.24 | 41.71 | 0.24 | 4.83 | 15.67 | 12.17 | 929.69 | 296.73 |

| TCMSX | TCM Small Cap Growth | 1209 | Domestic | Small | Growth | 3 | 1 | 17.18 | 36.04 | 15.2 | 44.7 | 20.1 | 20.33 | 18.78 | 16.48 | 1627.12 | 330.16 |

| DODGX | Dodge & Cox Stock | 527 | Domestic | Large | Value | 3 | 1 | 70.65 | 157.44 | 60.19 | 32.34 | 19.17 | 9.37 | 18.53 | 0.14 | 38890.11 | 32429.77 |

| DISVX | DFA Intl Small Cap Value I | 0 | Foreign | Medium | Value | 3 | 2 | 9.84 | 22.27 | 9.25 | 66.48 | 34.8 | 23.23 | 28.39 | 2.95 | 815.81 | 4466.72 |

| AEPGX | American Funds EuroPacific Gr A | 1671 | Foreign | Large | Value | 3 | 3 | 26.86 | 57.1 | 24.7 | 32.91 | 19.69 | 21.12 | 21.87 | 18.96 | 30504.69 | 71157.15 |

| TIVFX | Tocqueville International Value | 1627 | Foreign | Small | Value | 3 | 1 | 7.82 | 16.06 | 7.35 | 53.72 | 21.74 | 21.06 | 16.97 | 1.44 | 10534.1 | 113.55 |

| BREAX | BlackRock International Opp A | 1907 | Foreign | Medium | Growth | 3 | 1 | 19.61 | 48.4 | 17.62 | 48.59 | 23.53 | 31.8 | 31.46 | 18.13 | 9477.18 | 858.43 |

| ARTKX | Artisan International Value | 1866 | Foreign | Medium | Value | 3 | 3 | 16.45 | 28.72 | 15.07 | 56.59 | 32.26 | 10.09 | 34.46 | -0.67 | 6597.04 | 834.8 |

| ACIOX | American Century Intl Opport Instl | 1395 | Foreign | Medium | Growth | 3 | 3 | 3.63 | 11.63 | 3.41 | 40.3 | 27.49 | 36.75 | 24.29 | 22.57 | 1327.68 | 66.8 |

| OAKEX | Oakmark International Small Cap I | 890 | Foreign | Small | Value | 3 | 3 | 7.32 | 21.75 | 7.15 | 52.41 | 28.95 | 21.26 | 34.9 | -8.33 | 823.2 | 424.26 |

| NEWFX | American Funds New World A | 1798 | Foreign | Large | Growth | 3 | 1 | 28.83 | 65.42 | 26.33 | 43.36 | 20.79 | 22.2 | 33.42 | 32.85 | 12064.95 | 10191.07 |

| IEGAX | AIM International Small Company A | 1803 | Foreign | Medium | Growth | 3 | 1 | 9.25 | 29.07 | 8.72 | 75.1 | 35.83 | 32.21 | 38.18 | 17.39 | 934.26 | 263.52 |

insert Page Layout FormulasData Review View Developer Power Pivot Tell me what you want to do Cut Copy Format Painter Wrap Tot wrap Text Sort & Find & B l u. |-. . .. ___ Merge & Center. $. % , Conditional Format as Cell Insert Delete Format Formatting Table Styles Number Editing Investment Fund Type Size Categc Style Categ Risk Rank Return Rar Current Pri52-Week H 52-Week L Return 201 Return 201Rturn 201 Return 201 Return 201 Avg. Marke Fund Total Assets (Smil) 7 HRVIX Heartland Value Plus VASC Van Kampen Small Cap G 19.21 36.47 17.48 29.39 1927 8.39-10.89:23.45 21543.9 1586.64 12 HIMGX Harbor Mid Cap Growth 14 NMTAX Columbia Marsico 21st 5 TMCGX Turner Emerging Growth 16 VASVX Vanguard Selected Value 17 FDSSX Fidelity Stock Selector 18 VSGX Vanguard Small Cap Gro 19 EAVSXEaton Vance Small-Cap V 20 SSCTX RidgeWorth Small Cap G 1500 Domestic Small 21 LAUAX Columbia Acorn USA A 22 ARTQX Artisan Mid Cap Value 23 PRIDX T. Rowe Price International Discovery 24 CSCPX CMG Small Cap Value 1 29.55 65.5567 49.26 23.1910.86 14.65 17.34 958.1 Growth 27 HFMCK Hartford Midcap A 12.8 22.29 1111 35.8415.94 16.25 11.04 14.724122.81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts