Question: need to use bond method and FRA's Method Apple issued $1B of 5 -year floating-rate LIBOR based debt 12/31/2020 when LIBOR was .25%. The coupon

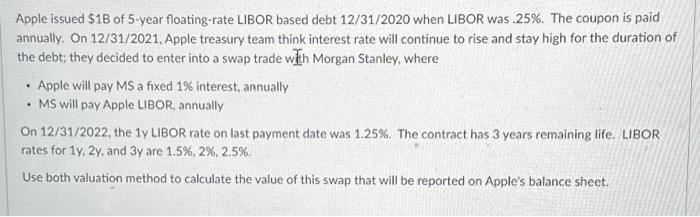

Apple issued $1B of 5 -year floating-rate LIBOR based debt 12/31/2020 when LIBOR was .25\%. The coupon is paid annually. On 12/31/2021. Apple treasury team think interest rate will continue to rise and stay high for the duration of the debt; they decided to enter into a swap trade with Morgan Stanley, where - Apple will pay MS a fixed 1% interest, annually - MS will pay Apple LIBOR, annually On 12/31/2022, the 1 Y LIBOR rate on last payment date was 1.25\%. The contract has 3 years remaining life. LIBOR rates for 1y,2y, and 3y are 1.5%,2%,2.5% Use both valuation method to calculate the value of this swap that will be reported on Apple's balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts