Question: Needed Correct answer please Question 1 (7 marks) (Note this question is based on the Topic 7 Lecture: Fringe Benefits Tax) GoodMates Pty Ltd loaned

Needed Correct answer please

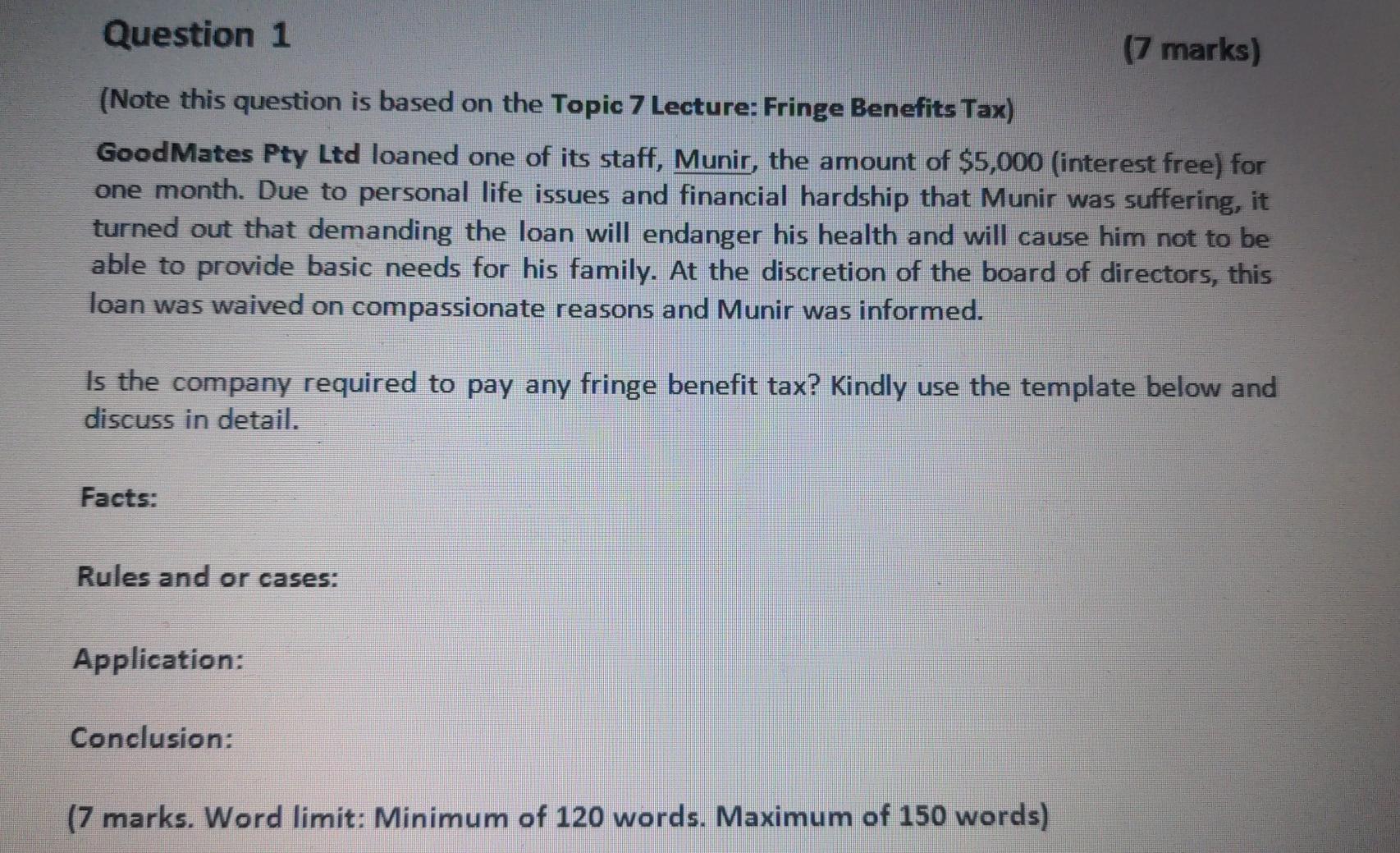

Question 1 (7 marks) (Note this question is based on the Topic 7 Lecture: Fringe Benefits Tax) GoodMates Pty Ltd loaned one of its staff, Munir, the amount of $5,000 (interest free) for one month. Due to personal life issues and financial hardship that Munir was suffering, it turned out that demanding the loan will endanger his health and will cause him not to be able to provide basic needs for his family. At the discretion of the board of directors, this loan was waived on compassionate reasons and Munir was informed. Is the company required to pay any fringe benefit tax? Kindly use the template below and discuss in detail. Facts: Rules and or cases: Application: Conclusion: (7 marks. Word limit: Minimum of 120 words. Maximum of 150 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts