Question: Needing answer to question 6. Posted question 5 because previous problem is needed to answer. 6. Calculating NPV For the cash flows in the previous

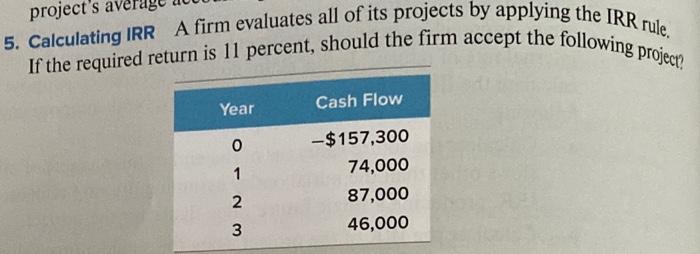

6. Calculating NPV For the cash flows in the previous problem, suppose the firm uses the NPV decision rule. At a required return of 9 percent, should the firm accept this project? What if the required return was 21 percent? project's 5. Calculating IRR A firm evaluates all of its projects by applying the IRR rule. If the required return is 11 percent, should the firm accept the following project? Year Cash Flow 0 -$157,300 1 74,000 2 87,000 3 46,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts