Question: needing help, NO.2 pls... 1. What is the difference between entering into a long forward contract when the forward price is s30 and taking a

needing help, NO.2 pls...

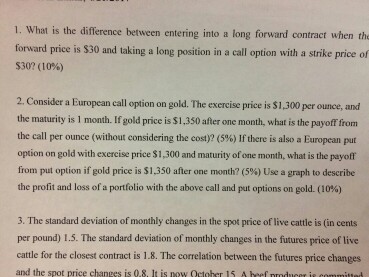

1. What is the difference between entering into a long forward contract when the forward price is s30 and taking a long position in a call option with a strike price of 2. Consider a European call option on gold. The exercise price is si300per ounce, and the maturity is 1 month. If gold price is S1,350 fter one month, what is the payoff from the call per ounce (without considering the cost? (5%) lf there is also a European put option on gold with exercise price si,300 and maturity of one month, what is the payoff from put option if gold price is si 350 after one month? (5%) Use a graph to describe the profit and loss of a portfolio with the above call and put options on gold. (10%) 3. The standard deviation of monthly changes in the spot price of live cattle is (in cents per pound) 1.5. The standard deviation of monthly changes in the futures price of live cattle for the closest contract is 1.8. The correlation between the futures price changes and the spot price changes is 0.8 lt is now october 15 A beef mrmduceri m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts