Question: needing help to figure out part 3 and 4 for question 1. I included my answers for the first two and the information given by

needing help to figure out part 3 and 4 for question 1. I included my answers for the first two and the information given by the question.

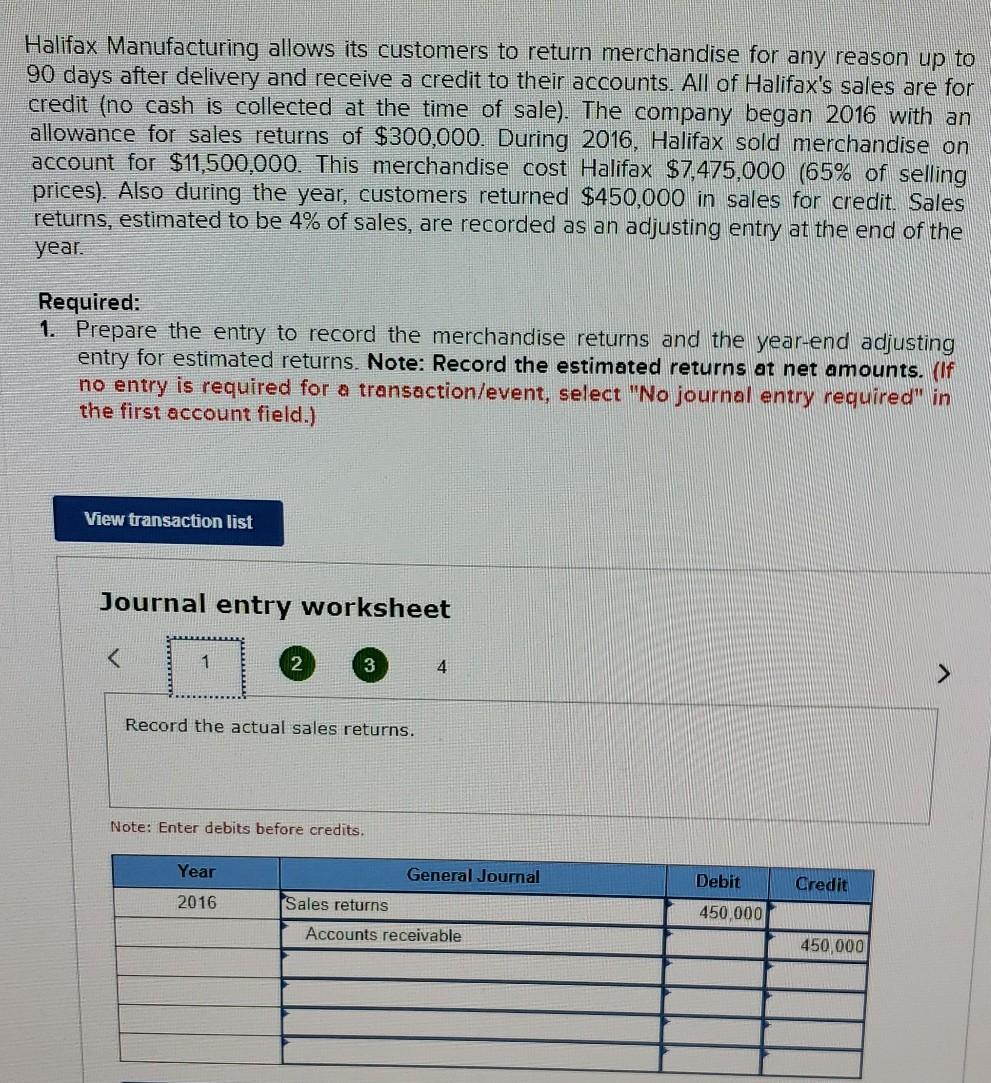

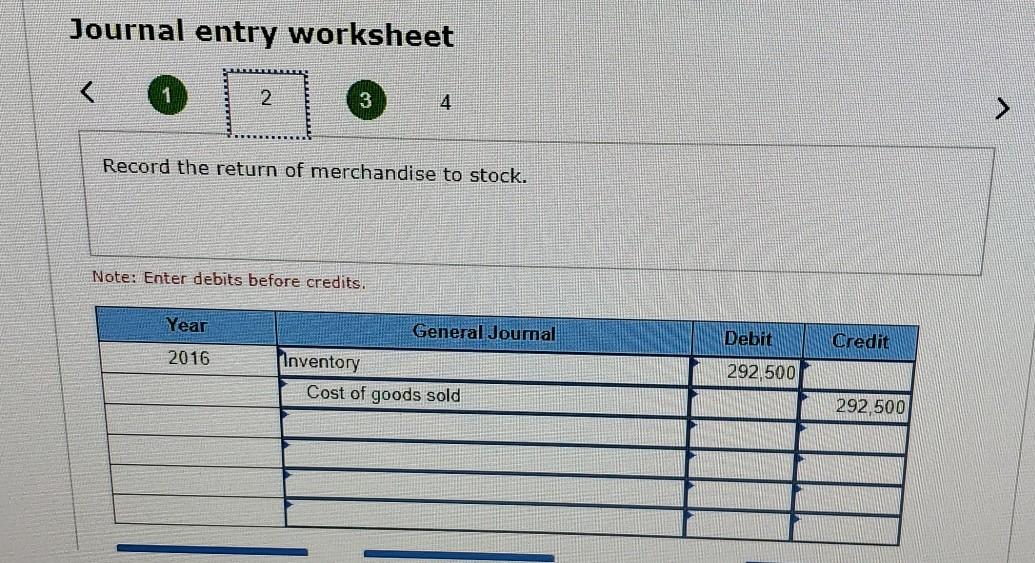

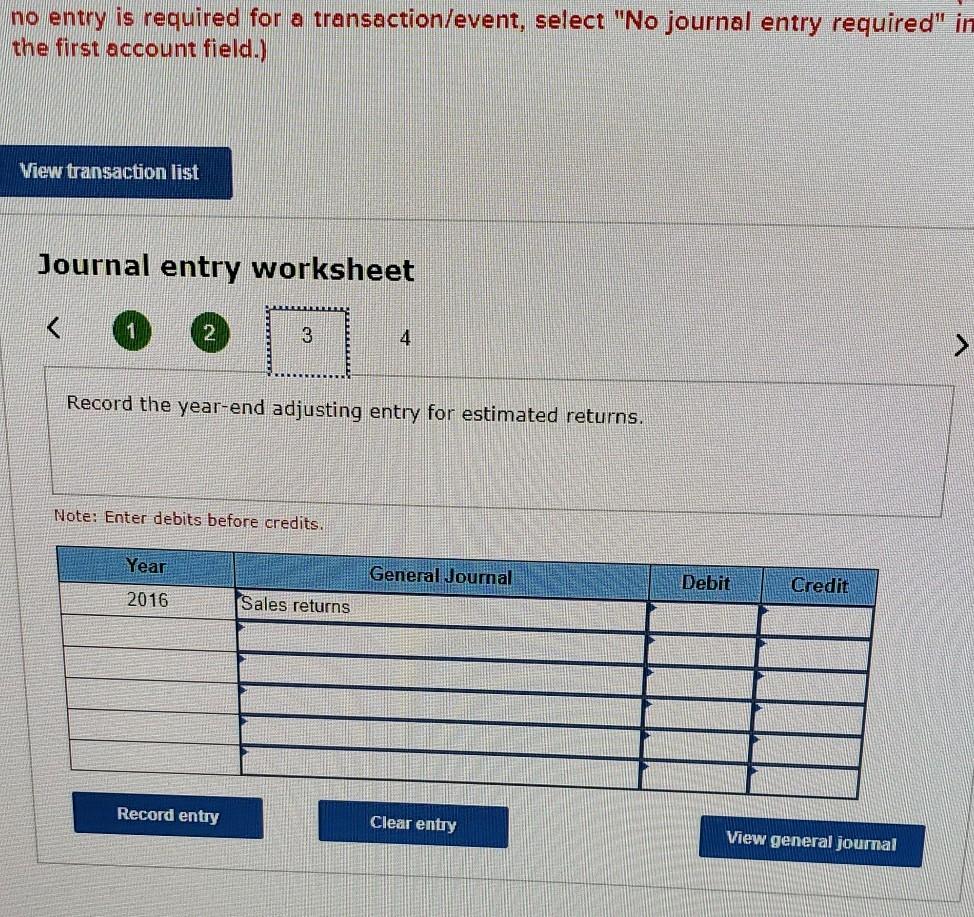

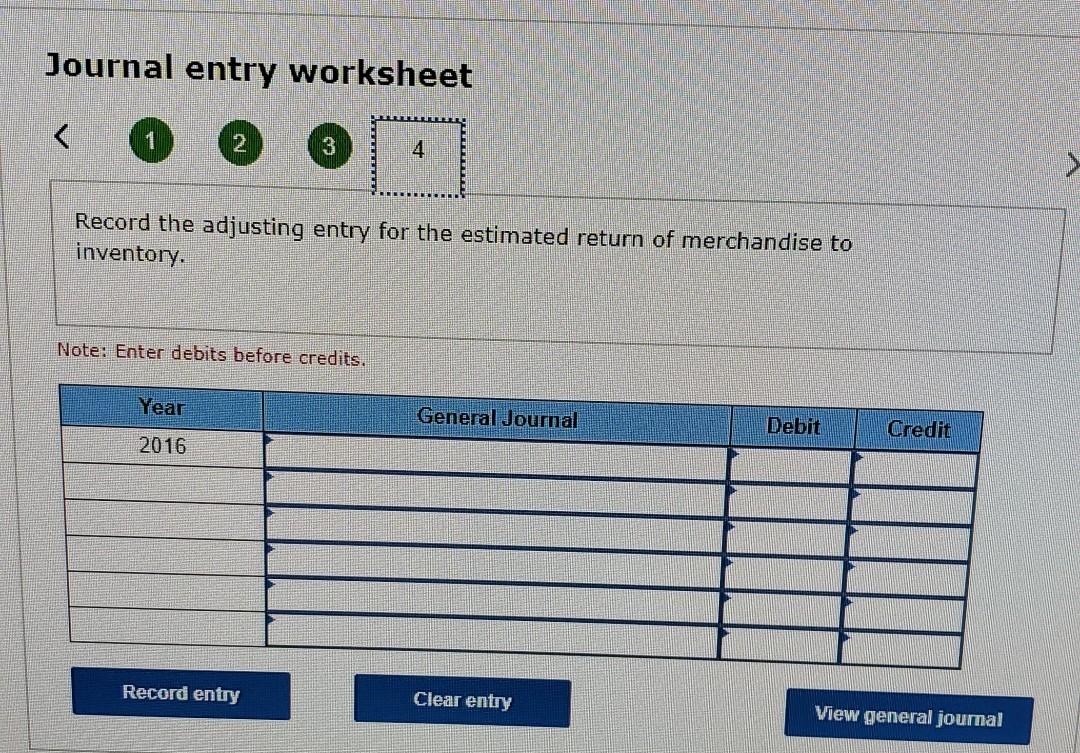

Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2016 with an allowance for sales returns of $300,000. During 2016, Halifax sold merchandise on account for $11,500,000. This merchandise cost Halifax $7,475,000 (65% of selling prices). Also during the year, customers returned $450,000 in sales for credit. Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare the entry to record the merchandise returns and the year-end adjusting entry for estimated returns. Note: Record the estimated returns at net amounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 3 4 > Record the actual sales returns. Note: Enter debits before credits. Year General Journal Credit 2016 Sales returns Accounts receivable Debit 450,000 450,000 Journal entry worksheet 2 3 4 Record the return of merchandise to stock. Note: Enter debits before credits. Year General Joumal Debit Credit 2016 Inventory Cost of goods sold 292,500 292,500 no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 (2 3 4 > Record the year-end adjusting entry for estimated returns. Note: Enter debits before credits. Year General Joumal Debit Credit 2016 Sales returns Record entry Clear entry View general journal Journal entry worksheet 4 Record the adjusting entry for the estimated return of merchandise to inventory. Note: Enter debits before credits. Year General Journal Debit Credit 2016 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts