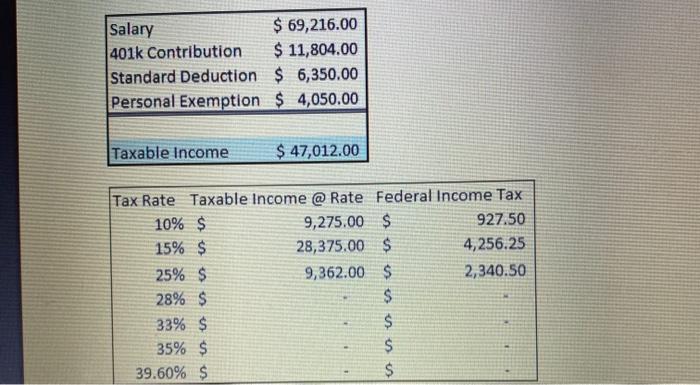

Question: needs done ASAP. I do not know how they are getting 28,375 and 9362. please include calculations to help solidify understanding Salary $ 69,216.00 401k

Salary $ 69,216.00 401k Contribution $ 11,804.00 Standard Deduction $ 6,350.00 Personal Exemption$ 4,050.00 Taxable income $ 47,012.00 Tax Rate Taxable income @ Rate Federal Income Tax 10% $ 9,275.00 $ 927.50 15% $ 28,375.00 $ 4,256.25 25% $ 9,362.00 $ 2,340.50 28% $ $ 33% $ $ 35% $ $ 39.60% $ $ Salary $ 69,216.00 401k Contribution $ 11,804.00 Standard Deduction $ 6,350.00 Personal Exemption$ 4,050.00 Taxable income $ 47,012.00 Tax Rate Taxable income @ Rate Federal Income Tax 10% $ 9,275.00 $ 927.50 15% $ 28,375.00 $ 4,256.25 25% $ 9,362.00 $ 2,340.50 28% $ $ 33% $ $ 35% $ $ 39.60% $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts