Question: Needs Grading Question 4 Abdulla had some put options. He decided to exercise his options today. How do we call the amount of money per

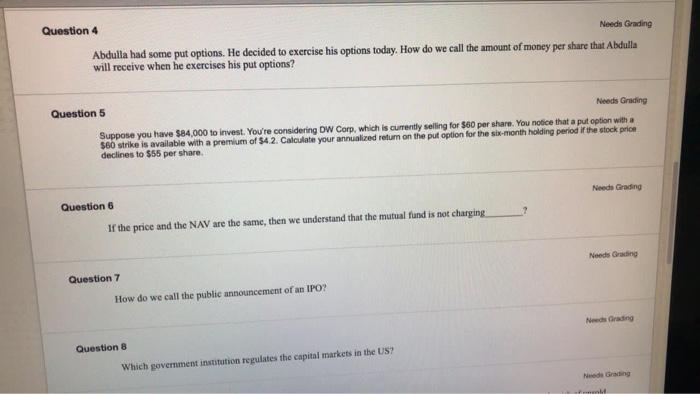

Needs Grading Question 4 Abdulla had some put options. He decided to exercise his options today. How do we call the amount of money per share that Abdulla will receive when he exercises his put options? Question 5 Needs Grading Suppose you have $84,000 to invest. You're considering DW Corp, which is currently selling for $60 per share. You notice that a put option with a $60 strike is available with a premium of 54.2. Calculate your annualized return on the put option for the six-month holding period if the stock price declines to $55 per share Needs Grading Question 6 If the price and the NAV are the same, then we understand that the mutual fund is not charging Needs Grading Question 7 How do we call the public announcement of an IPO? Needs Grading Question 8 Which government institution regulates the capital markets in the US? de Grading ht Needs Grading Question 4 Abdulla had some put options. He decided to exercise his options today. How do we call the amount of money per share that Abdulla will receive when he exercises his put options? Question 5 Needs Grading Suppose you have $84,000 to invest. You're considering DW Corp, which is currently selling for $60 per share. You notice that a put option with a $60 strike is available with a premium of 54.2. Calculate your annualized return on the put option for the six-month holding period if the stock price declines to $55 per share Needs Grading Question 6 If the price and the NAV are the same, then we understand that the mutual fund is not charging Needs Grading Question 7 How do we call the public announcement of an IPO? Needs Grading Question 8 Which government institution regulates the capital markets in the US? de Grading ht

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts