Question: needs help in 4questions Present values& future value Fine Shipping Corporation's required rate of return is 12%. The company is considering an investment that would

needs help in 4questions

Present values& future value

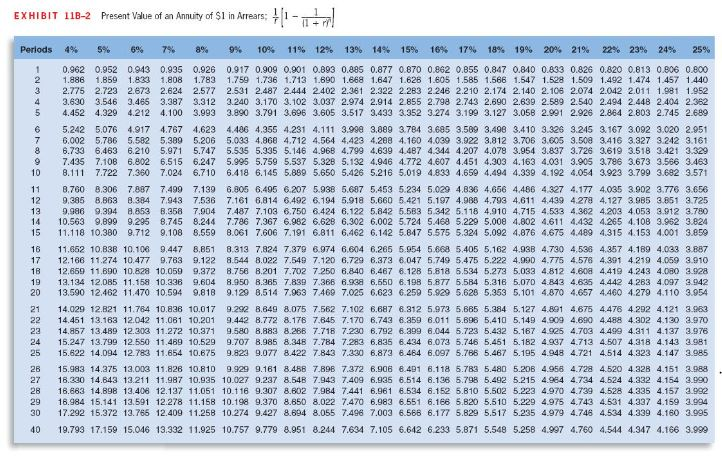

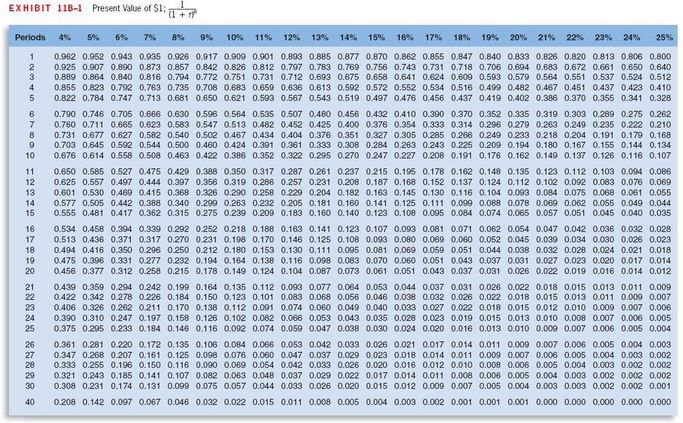

$5,387. $16,755. $2,635. $34,248. ----------- Arch Company is considering purchasing a machine that would cost $320,000 and would last for 6 years. At the end of 6 years, the machine would have a salvage value of $50,000. The machine would provide annual cost savings of $75,000. The company requires a rate of return of 11% on all investment projects. What is the net present value of the proposed project? (Select the answer that is closest to your calculations.) $40,125 $24,075 $47,325 -$2,675 -------------------

$37,788. $67,000. $118,794. $15,385. --------------------------------- Marcus Production Company has $96,000 to invest in either Project A or Project B. The following data are available on these projects:

Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. The company's required rate of return is 14%. What is the net present value of Project B? (Select the answer that is closest to your calculated amount.) rev: 12_14_2012, 12_21_2012 $13,440 $28,893 $57,725 $4,725 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts