Question: needs help in 4questions Present values& future value Swift Manufacturing Company is considering the purchase of a machine for $15,000 that would reduce operating costs

needs help in 4questions

Present values& future value

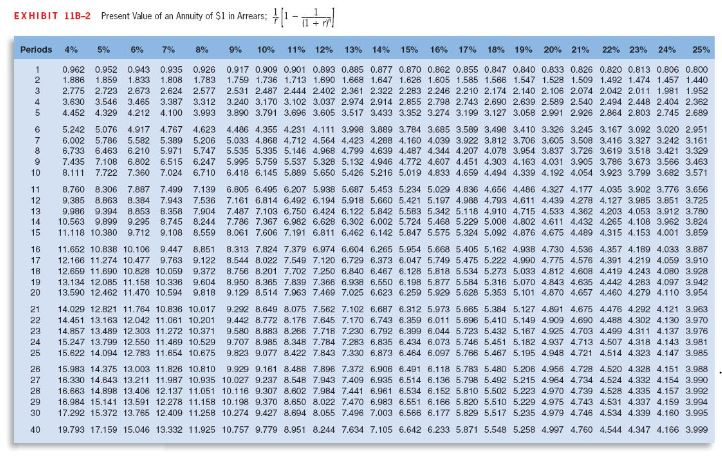

Swift Manufacturing Company is considering the purchase of a machine for $15,000 that would reduce operating costs by $5,000 per year for 10 years. The machine will have no scrap value (residual value) at the end of its 10-year useful life. The company's required rate of return is 11%.

What is the net present value of the investment in the machine? (Select the answer that is closest to your calculations.)

$14,445

$18,450

$35,000

$29,448

----------------------------

| The following information pertains to a proposed investment: |

| Discount rate | 9% |

| Life of the project | 6 years |

| Initial investment cost | $60,561 |

| Annual cost savings | 13,500 |

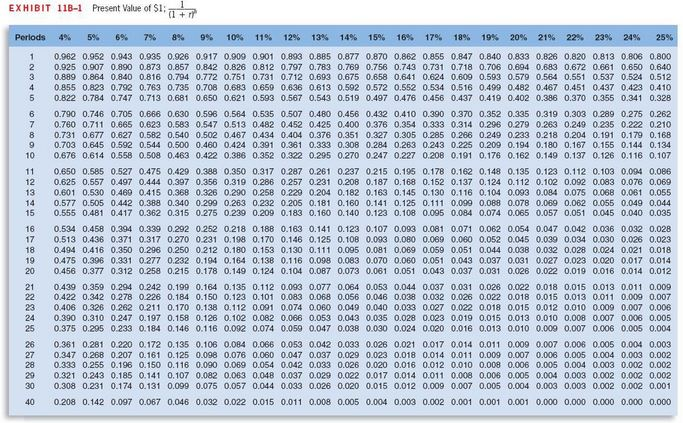

| Salvage value | 2,700 |

| What is the net present value of the proposed investment? (Select the answer that is closest to your calculations.) |

$0.

$1,609.

?$1,609.

$60,561.

----------------------------------------------------

New Venture Corporation has $30,000 available to invest in either Project J or Project K. The company's required rate of return (discount rate) is 15%. The following data are available on these projects:

| Project J | Project K | |

| Investment required | $ 30,000 | $ 30,000 |

| Annual cash inflows | $ 10,000 | 0 |

| Single cash inflow at the end of 7 years | 0 | $ 80,000 |

| Life of the project | 7 years | 7 years |

What is the net present value of Project J? (Select the answer that is closest to your calculations.)

$ 10,500

$ 602

$ 11,600

$ 40,000

------------------------------

In managerial accounting, the capital budgeting method that recognizes the time value of money by discounting cash flows over the life of the project, using the company's required rate of return as the discount rate, is called the:

financing method.

payback method.

net present value method.

simple rate of return method.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts