Question: Neeed help with this questions? I'm struggling Additional first year (bonus) depreciation is required: Only on real estate purchased during the year None of the

Neeed help with this questions? I'm struggling

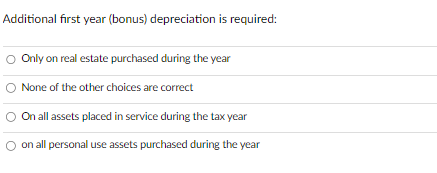

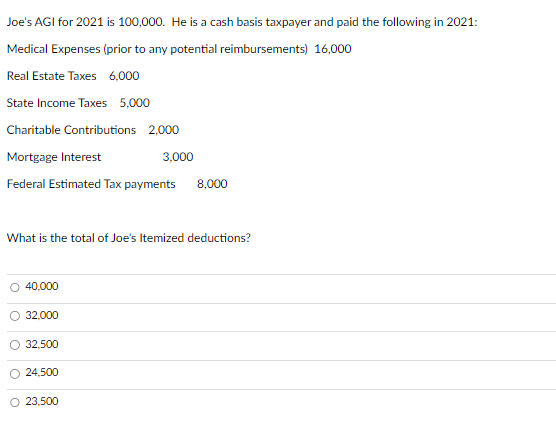

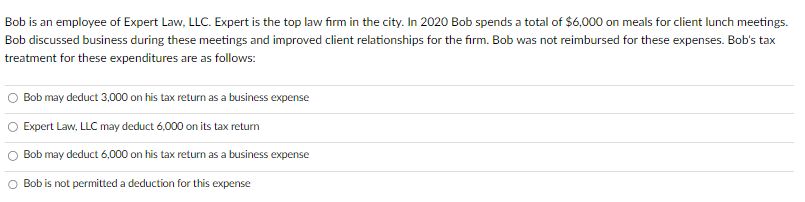

Additional first year (bonus) depreciation is required: Only on real estate purchased during the year None of the other choices are correct On all assets placed in service during the tax year on all personal use assets purchased during the year Joe's AGI for 2021 is 100,000 . He is a cash basis taxpayer and paid the following in 2021 : Medical Expenses (prior to any potential reimbursements) 16,000 What is the total of Joe's Itemized deductions? 40,000 32,000 32,500 24,500 23,500 Bob is an employee of Expert Law, LLC. Expert is the top law firm in the city. In 2020 Bob spends a total of $6,000 on meals for client lunch meetings. Bob discussed business during these meetings and improved client relationships for the firm. Bob was not reimbursed for these expenses. Bob's tax treatment for these expenditures are as follows: Bob may deduct 3,000 on his tax return as a business expense Expert Law, LLC may deduct 6,000 on its tax return Bob may deduct 6,000 on his tax return as a business expense Bob is not permitted a deduction for this expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts