Question: Negative amortization fixed rate mortgage (CPM) Create a monthly amortization schedule for a negatively amortized $250K, 5yr, 4.75% fixed rate mortgage. The monthly payments on

Negative amortization fixed rate mortgage (CPM)

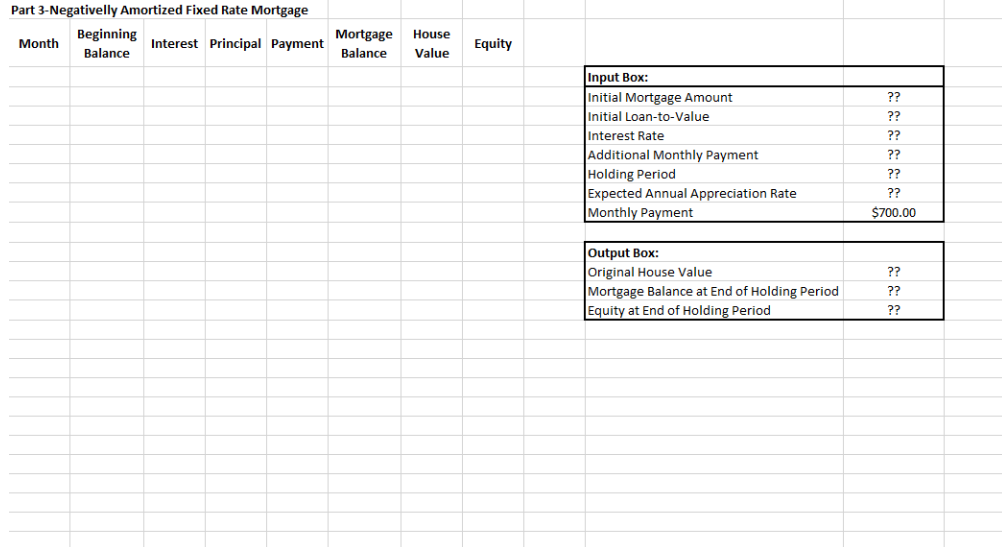

- Create a monthly amortization schedule for a negatively amortized $250K, 5yr, 4.75% fixed rate mortgage. The monthly payments on the mortgage are $700. The original loan balance is 97% of the value of the house when initiated and the house is expected to depreciate at a rate of 1.50% annually.

- What is the remaining loan balance at the end of the holding period if the homeowner sells the home after 59 months?

- Illustrate with a well-labeled graph the amount of equity the homeowner builds throughout the holding period of the loan.

- What is the owner equity in the house at the time the house is sold?

Part 3-Negativelly Amortized Fixed Rate Mortgage Beginning Month Interest Principal Payment Balance Mortgage Balance House Value Equity Input Box: Initial Mortgage Amount Initial Loan-to-Value Interest Rate Additional Monthly Payment Holding Period Expected Annual Appreciation Rate Monthly Payment ?? ?? ?? ?? ?? ?? $700.00 Output Box: Original House Value Mortgage Balance at End of Holding Period Equity at End of Holding Period ?? ?? ?? Part 3-Negativelly Amortized Fixed Rate Mortgage Beginning Month Interest Principal Payment Balance Mortgage Balance House Value Equity Input Box: Initial Mortgage Amount Initial Loan-to-Value Interest Rate Additional Monthly Payment Holding Period Expected Annual Appreciation Rate Monthly Payment ?? ?? ?? ?? ?? ?? $700.00 Output Box: Original House Value Mortgage Balance at End of Holding Period Equity at End of Holding Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts