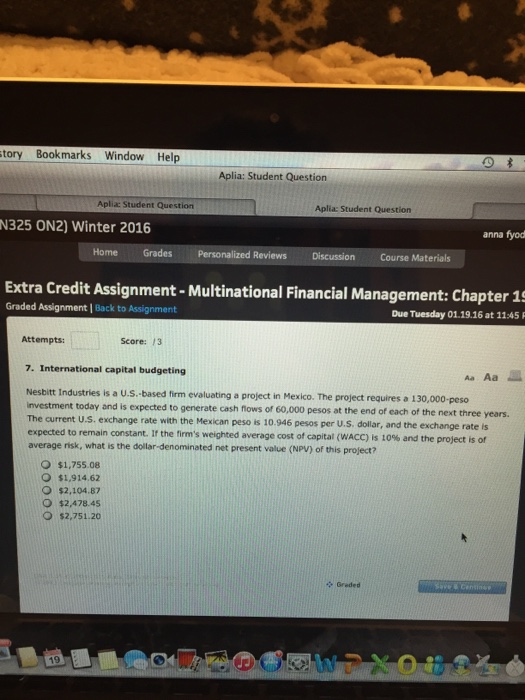

Question: Nesbitt Industries is a U.S.-based firm evaluating a project in Mexico. The project requires a 130,000-peso investment today and Is expected to generate cash flows

Nesbitt Industries is a U.S.-based firm evaluating a project in Mexico. The project requires a 130,000-peso investment today and Is expected to generate cash flows of 60,000 pesos at the end of each of the next three years. The current U.S. exchange rate with the Mexican peso is 10 946 pesos per U.S dollar, and the exchange rate is expected to remain constant. If the firms weighted average cost of capital (WACC) is 10% and the project is of average risk. what is the dollar denominated not present value (NPV) of this project

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock