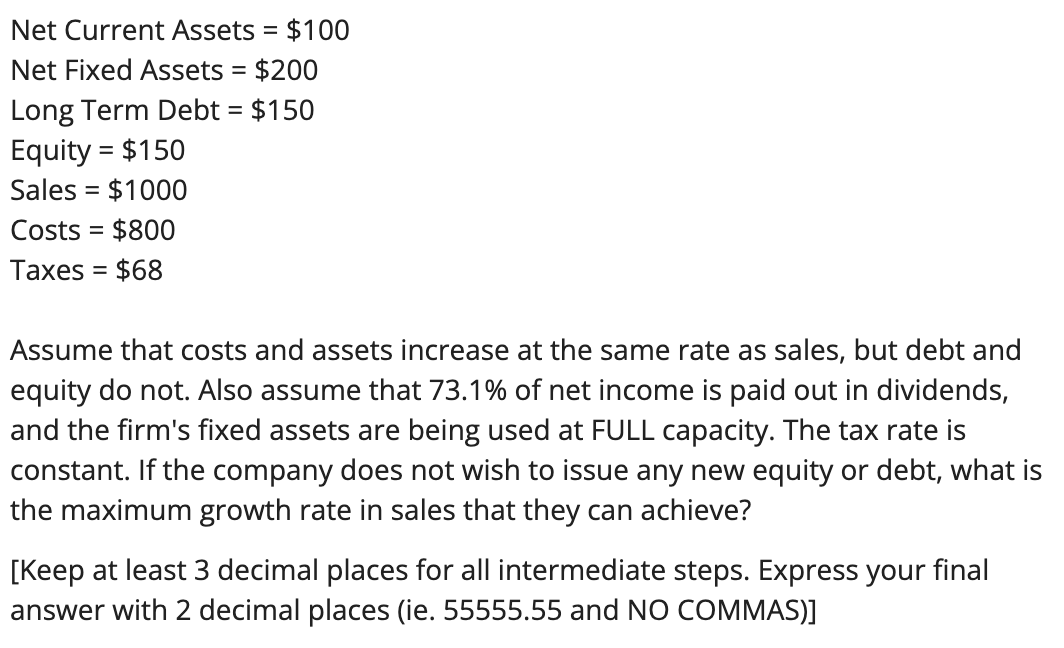

Question: - = Net Current Assets = $100 Net Fixed Assets = $200 Long Term Debt = $150 Equity = $150 Sales = $1000 Costs =

- = Net Current Assets = $100 Net Fixed Assets = $200 Long Term Debt = $150 Equity = $150 Sales = $1000 Costs = $800 Taxes = $68 = = Assume that costs and assets increase at the same rate as sales, but debt and equity do not. Also assume that 73.1% of net income is paid out in dividends, and the firm's fixed assets are being used at FULL capacity. The tax rate is constant. If the company does not wish to issue any new equity or debt, what is the maximum growth rate in sales that they can achieve? [Keep at least 3 decimal places for all intermediate steps. Express your final answer with 2 decimal places (ie. 55555.55 and NO COMMAS)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts