Question: 2 Click to see additional instructions Consider the following figures: = - Net Current Assets = $100 Net Fixed Assets = $200 Long Term Debt

2

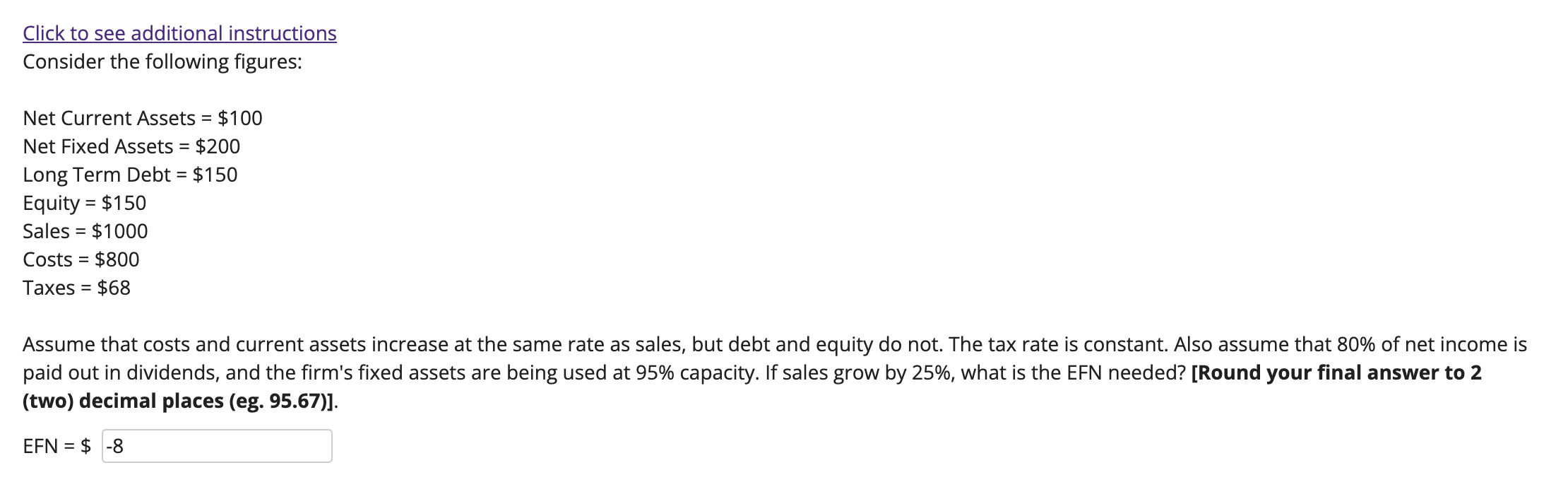

Click to see additional instructions Consider the following figures: = - Net Current Assets = $100 Net Fixed Assets = $200 Long Term Debt = $150 Equity = $150 Sales = $1000 Costs = $800 Taxes = $68 = - Assume that costs and current assets increase at the same rate as sales, but debt and equity do not. The tax rate is constant. Also assume that 80% of net income is paid out in dividends, and the firm's fixed assets are being used at 95% capacity. If sales grow by 25%, what is the EFN needed? [Round your final answer to 2 (two) decimal places (eg. 95.67)]. EFN = $ -8

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock