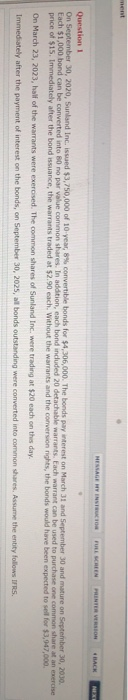

Question: net HESSAGE HY IN FULL SCREEN HENTER VERSION MEX Question 1 On September 30, 2020, Sunland Inc. issued $3,750,000 of 10 year, 8% convertible bonds

net HESSAGE HY IN FULL SCREEN HENTER VERSION MEX Question 1 On September 30, 2020, Sunland Inc. issued $3,750,000 of 10 year, 8% convertible bonds for $4,306,000. The bonds pay interest on March 31 and September 30 and mature on September 30, 2030. Each $1,000 bond can be converted into 80 no par value common shares. In addition, each bond included 20 detachable warrants. Each warrant can be used to purchase one common share at an exercise price of $15. Immediately after the bond issuance, the warrants traded at $2.90 each. Without the warrants and the conversion nights, the bonds would have been expected to sell for $3,947,000 On March 23, 2023, half of the warrants were exercised. The common shares of Sunland Inc. were trading at $20 each on this day Immediately after the payment of interest on the bonds, on September 30, 2025, al bonds outstanding were converted into common shares. Assume the entity follows IRS. net HESSAGE HY IN FULL SCREEN HENTER VERSION MEX Question 1 On September 30, 2020, Sunland Inc. issued $3,750,000 of 10 year, 8% convertible bonds for $4,306,000. The bonds pay interest on March 31 and September 30 and mature on September 30, 2030. Each $1,000 bond can be converted into 80 no par value common shares. In addition, each bond included 20 detachable warrants. Each warrant can be used to purchase one common share at an exercise price of $15. Immediately after the bond issuance, the warrants traded at $2.90 each. Without the warrants and the conversion nights, the bonds would have been expected to sell for $3,947,000 On March 23, 2023, half of the warrants were exercised. The common shares of Sunland Inc. were trading at $20 each on this day Immediately after the payment of interest on the bonds, on September 30, 2025, al bonds outstanding were converted into common shares. Assume the entity follows IRS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts