Question: A firm is considering two different capital structures, one with 3 0 percent leverage and one that is all - equity. Under these structures, the

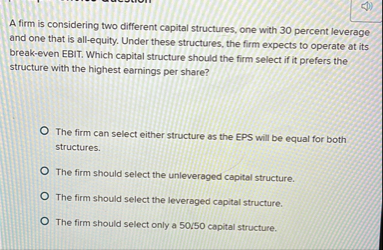

A firm is considering two different capital structures, one with percent leverage and one that is allequity. Under these structures, the firm expects to operate at its breakeven EBIT. Which capital structure should the firm select if it prefers the structure with the highest earnings per share?

The firm can select either structure as the EPS will be equal for both structures.

The firm should select the unleveraged capital structure.

The firm should select the leveraged capital structure.

The firm should select only a capital structure.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock