Question: . NET PRESENT VALUE (20 points) A plastic manufacturing company has made a strategic decision to purchase a fleet of 3- D printers and use

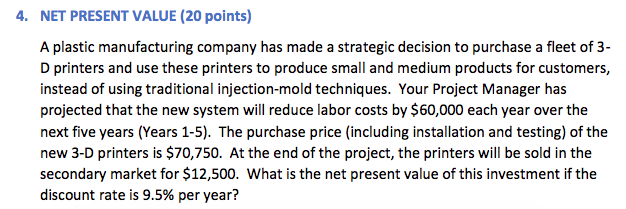

. NET PRESENT VALUE (20 points) A plastic manufacturing company has made a strategic decision to purchase a fleet of 3- D printers and use these printers to produce small and medium products for customers, instead of using traditional injection-mold techniques. Your Project Manager has projected that the new system will reduce labor costs by $60,000 each year over the next five years (Years 1-5). The purchase price (including installation and testing) of the new 3-D printers is $70,750. At the end of the project, the printers will be sold in the secondary market for $12,500. What is the net present value of this investment if the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts