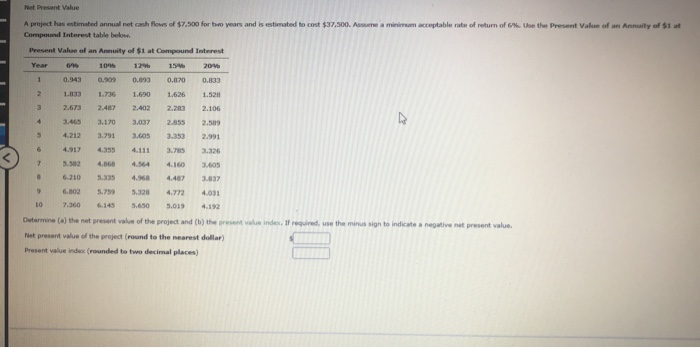

Question: Net Present Value A project has estimated annual net cash flows of $7.500 for two years and is estimated to cost $37,500. Assume a minimum

Net Present Value A project has estimated annual net cash flows of $7.500 for two years and is estimated to cost $37,500. Assume a minimum acceptable rate of return of 6%. Use the Present Value of an Annuity of $1 at Compound Interest table below Present Value of an Annuity of $1 at Compound Interest Year 6 100 12 15 20V 1 0.943 0.900 0.09 0.00 0.833 1.133 1.736 1.690 1.626 1.52 3 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3.037 2.855 2.509 5 4.212 3.791 3.60 3.353 2.991 6 4.917 4.355 3.785 3.326 7 3.502 4,866 4.160 34605 6.210 5.335 4.960 4.487 3,037 9 6.002 5.320 4.772 10 7.360 5.650 5.019 Determine (a) the net present value of the project and (b) the rest value index. If required, use the mission to indicate a negative not present value. Net present value of the project (round to the nearest dollar) Present value Index (rounded to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts