Question: Net Present Value A project has estimated annual net cash flows of $7,500 for eight years and is estimated to cost $35,000. Assume a minimum

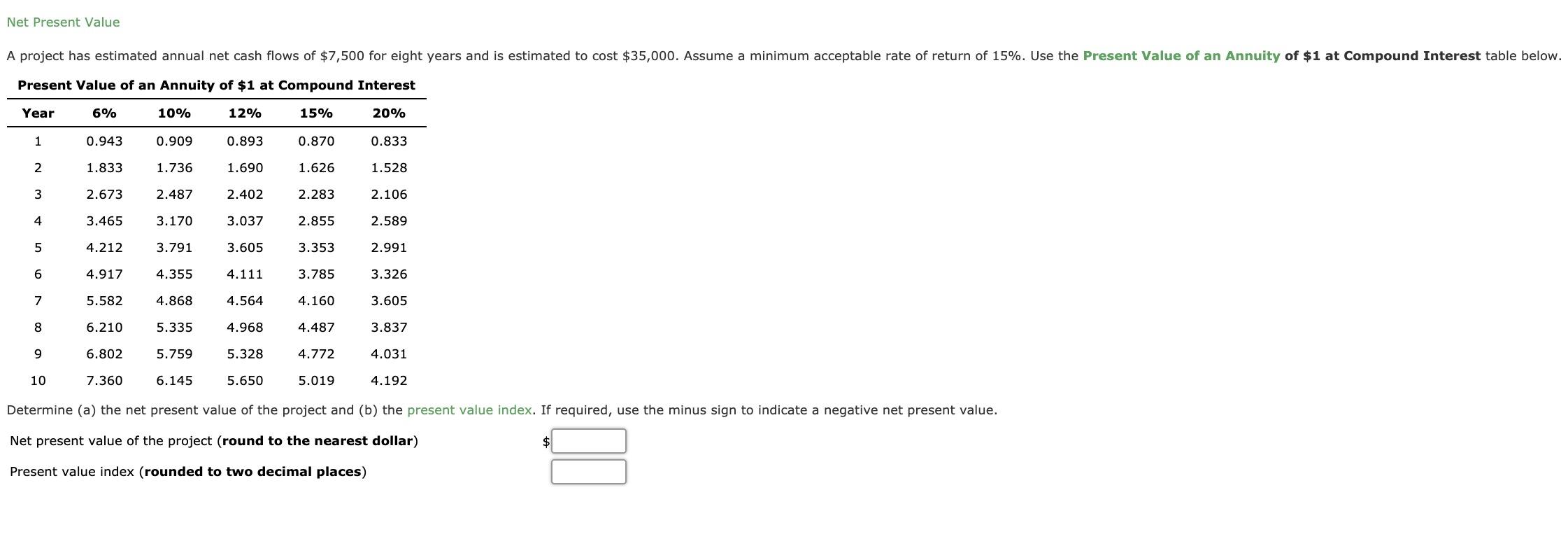

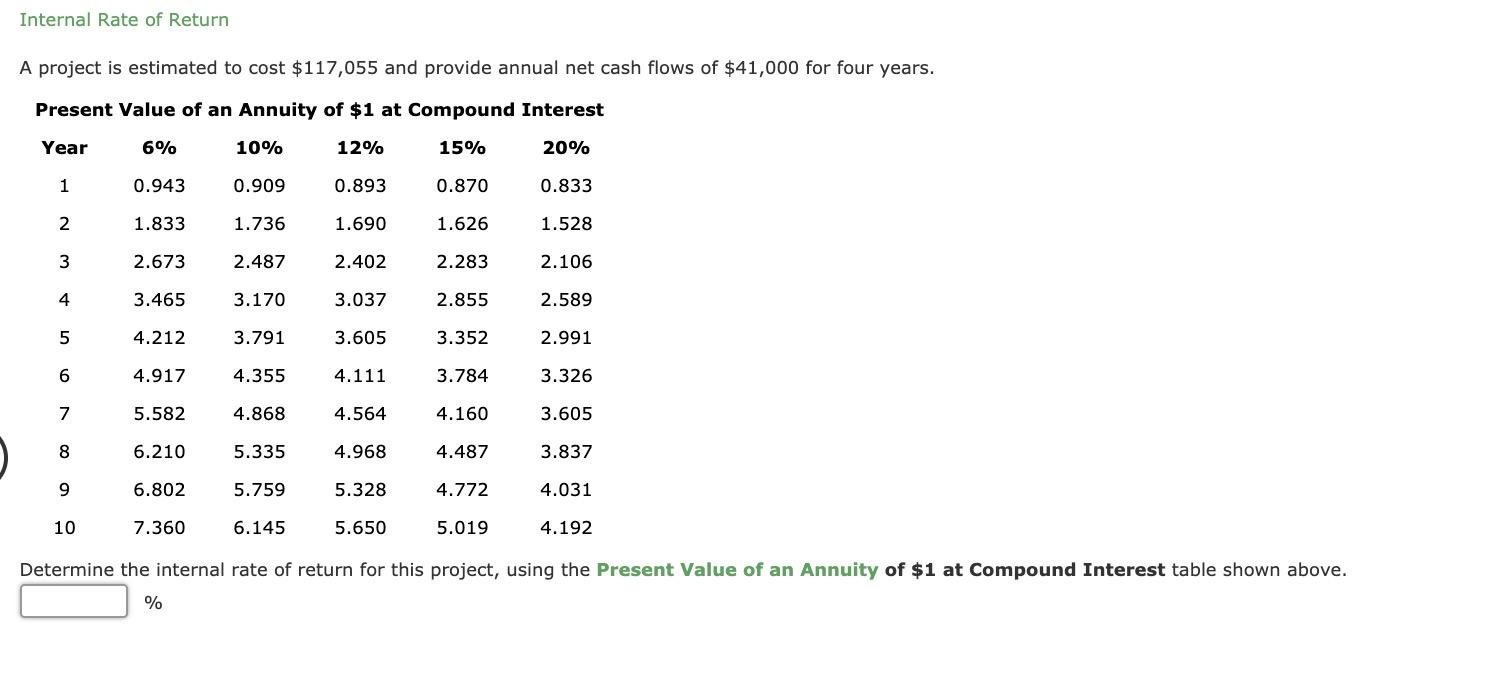

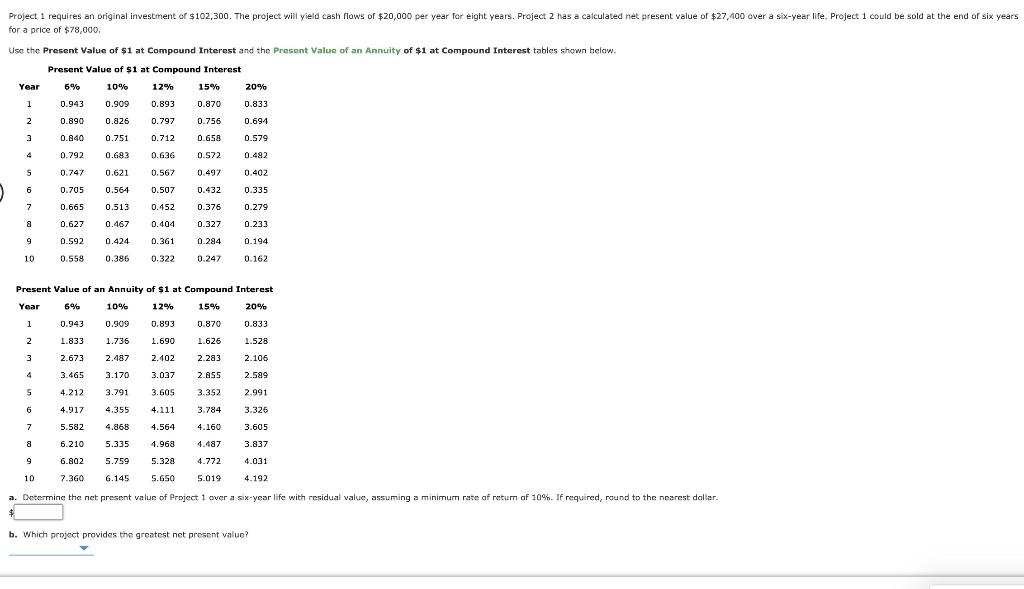

Net Present Value A project has estimated annual net cash flows of $7,500 for eight years and is estimated to cost $35,000. Assume a minimum acceptable rate of return of 15%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (a) the net present value of the project and (b) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) $ Present value index (rounded to two decimal places) Internal Rate of Return A project is estimated to cost $117,055 and provide annual net cash flows of $41,000 for four years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine the internal rate of return for this project, using the Present Value of an Annuity of $1 at Compound Interest table shown above. % Project 1 requires an original investment of $102,300. The project will yield cash flows of $20,000 per year for eight years. Project 2 has a calculated net present value of $27,400 over a six-year life. Project 1 could be sold at the end of six years for a price of $78,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Year Present Value of si at Compound Interest 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 1 3 3 0.712 0.658 0.579 0.840 0.792 0.751 0.683 4 0.636 0.482 0.572 0.497 5 0.747 0.621 0.567 0.402 6 0.705 0.507 0.432 0.335 0.564 0.513 7 7 0.665 0.452 0.376 0.279 a 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Present Value of an Annuity of si at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.625 1.528 1.690 2.402 3 3 2.673 2.487 2.283 2.106 3.465 3.170 3.037 2.955 2.589 S 5 3.791 3.605 3.352 2.991 4.212 4.917 6 4.355 4. 111 3.326 3.784 4.160 7 5.582 4.564 3.605 4.868 5.335 8 8 4.968 4.487 3.837 6.210 6.802 9 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the net present value of Project 1 over a six-year life with residual value, assuming a minimum rate of retum of 10%. If required, round to the nearest dallar. b. Which project provides the greatest net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts