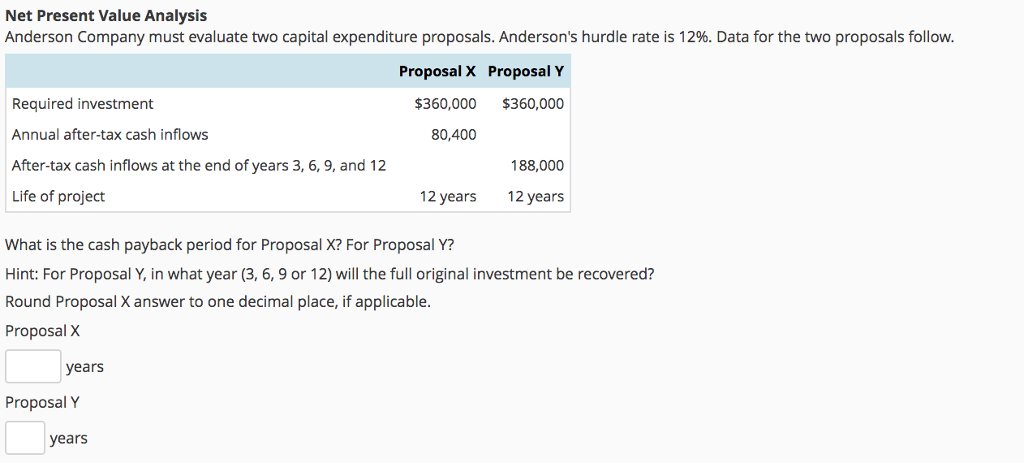

Question: Net Present Value Analysis Anderson Company must evaluate two capital expenditure proposals. Anderson's hurdle rate is 12%. Data for the two proposals follow. Proposal X

Net Present Value Analysis Anderson Company must evaluate two capital expenditure proposals. Anderson's hurdle rate is 12%. Data for the two proposals follow. Proposal X Proposal Y $360,000 $360,000 Required investment Annual after-tax cash inflows After-tax cash inflows at the end of years 3, 6, 9, and 12 Life of project 188,000 2 years 12 years What is the cash payback period for Proposal X? For Proposal Y? Hint: For Proposal Y, in what year (3, 6,9 or 12) will the full original investment be recovered? Round Proposal X answer to one decimal place, if applicable. Proposal X years Proposal Y years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts