Question: Net Present Value Analysis for New Facility An organization is considering a new retail facility and is convinced the facility will be profitable due to

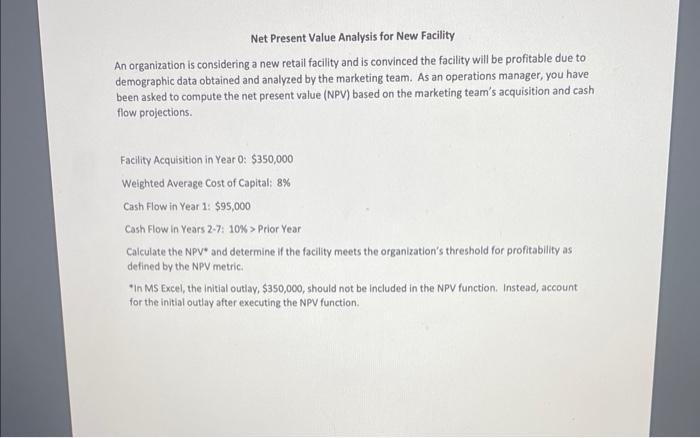

Net Present Value Analysis for New Facility An organization is considering a new retail facility and is convinced the facility will be profitable due to demographic data obtained and analyzed by the marketing team. As an operations manager, you have been asked to compute the net present value (NPV) based on the marketing team's acquisition and cash. flow projections. Facility Acquisition in Year 0: $350,000 Weighted Average Cost of Capital: 8% Cash Flow in Year 1: $95,000 Cash Flow in Years 2-7: 10N > Prior Year Calculate the NPV* and determine if the facility meets the organization's threshold for profitability as defined by the NPV metric. "In MS Excel, the initial outlay, $350,000, should not be included in the NPV function. Instead, account for the initial outlay after executing the NPV function

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts