Question: Net Present Value Analysis for New Facility An organization is considering a new retail facility and is convinced the facility will be profitable due to

Net Present Value Analysis for New Facility

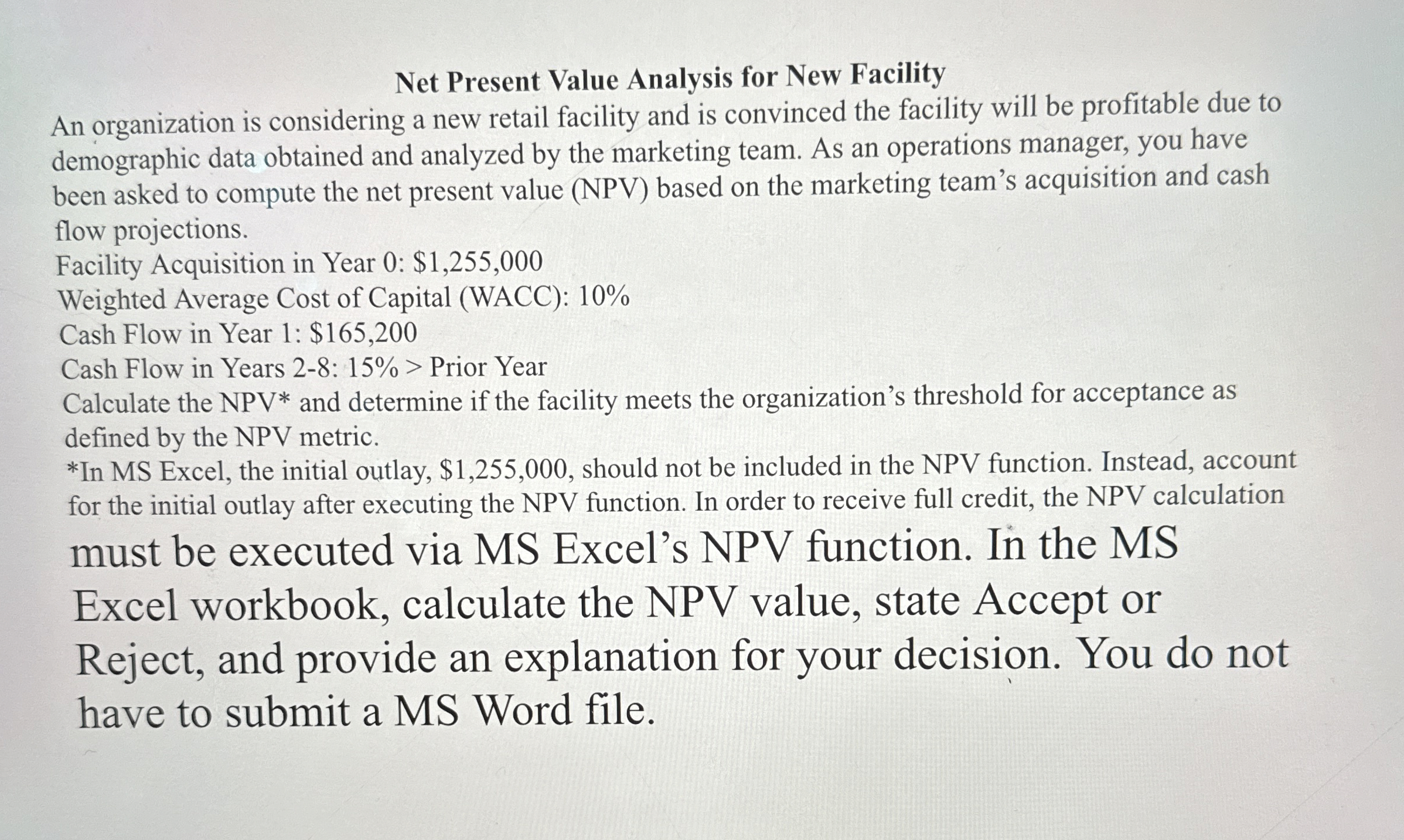

An organization is considering a new retail facility and is convinced the facility will be profitable due to demographic data obtained and analyzed by the marketing team. As an operations manager, you have been asked to compute the net present value NPV based on the marketing team's acquisition and cash flow projections.

Facility Acquisition in Year : $

Weighted Average Cost of Capital WACC:

Cash Flow in Year : $

Cash Flow in Years : Prior Year

Calculate the and determine if the facility meets the organization's threshold for acceptance as defined by the NPV metric.

In MS Excel, the initial outlay, $ should not be included in the NPV function. Instead, account for the initial outlay after executing the NPV function. In order to receive full credit, the NPV calculation must be executed via MS Excel's NPV function. In the MS Excel workbook, calculate the NPV value, state Accept or Reject, and provide an explanation for your decision. You do not have to submit a MS Word file.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock